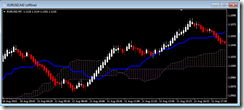

EURUSD is sliding on this Renko Chart

This morning the EURUSD pair is down considerably after rising earlier.

You can see on this Renko chart that price has fallen from a high of 1.1309 to 1.1258.

The fall in the EURUSD today may be related to a softening rate of inflation in Europe as well as today’s meeting of the European Central Bank. There is some feeling that there will be Quantitative Easing proposed which may have considerable effect on the EURUSD.

Her are a couple current articles on EURUSD.

Slowing German CPI to Hit EUR/USD Ahead of ECB Meeting? - DailyFX

http://news.google.com Fri, 28 Aug 2015 08:00:26 GMT

Slowing German CPI to Hit EUR/USD Ahead of ECB Meeting?DailyFXSigns of slowing inflation in Europe's largest economy may drag on EUR/USD and push the European Central Bank (ECB) to broaden its quantitative easing (QE) program as it undermines the Gov ...

Read more ...

EUR/USD Technical Analysis: Aiming Below 1.12 Figure - DailyFX

http://news.google.com Fri, 28 Aug 2015 03:45:45 GMT

Read more ...

Trade Idea: EUR/USD - Sell at 1.1370 - Action Forex

http://news.google.com Fri, 28 Aug 2015 08:30:56 GMT

Trade Idea: EUR/USD - Sell at 1.1370Action ForexAs the single currency has recovered after falling to 1.1203 yesterday, suggesting consolidation above this level would be seen and corrective bounce to resistance at 1.1364 cannot be ruled out, however ...

Read more ...