The July Trade Numbers

The Chinese government saw a drop of 8.9 percent in exports for July and reacted swiftly with a devaluation of the Yuan. Being the world’s largest goods trader, China has set up for many changes to happen around the world.(Xinhua)

Zhang Xiaohui, assistant governor of China's central bank, said the value of the yuan has gradually returned to market levels as the discrepancy between the central parity rate and the actual trading rate has been largely corrected after declines early this week.

"There are no grounds for persistent and substantial depreciation as sound economic fundamentals determine that the yuan will re-enter a rising streak," said Zhang.

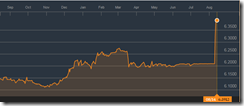

Here is a one year chart of the USDCNY from Bloomberg

To understand what is happening with the Yuan will take a significant amount of research and consideration of a lot of opinions. Our weekend will be filled with studying the effects of the recent moves in the Yuan. Many currency pairs will be affected by this move and that will develop in coming days.

I have gathered several articles below, and, as well, Bloomberg has quite a collection of articles on their site at this link.

China's Yuan Could Fall 10% or More - Barron's

http://news.google.com Sat, 15 Aug 2015 05:40:31 GMT

Read more ...

China Gambles with the Yuan - The New Yorker

http://news.google.com Fri, 14 Aug 2015 12:08:45 GMT

Read more ...

IMF Calls China's Yuan Moves Welcome Step to More Flexible Rate - Bloomberg

http://news.google.com Sat, 15 Aug 2015 00:15:48 GMT

Read more ...

Many factors at play in the devaluation of yuan - Marketplace.org

http://news.google.com Fri, 14 Aug 2015 21:29:51 GMT

Read more ...

Stocks end week lower, bruised by China yuan weakness - Reuters

http://news.google.com Fri, 14 Aug 2015 20:59:00 GMT

Read more ...

China policymakers may lose control of yuan: Trader - CNBC

http://news.google.com Fri, 14 Aug 2015 12:15:51 GMT

Read more ...

Wall St settles after yuan shock week - The Australian Financial Review

http://news.google.com Fri, 14 Aug 2015 21:08:58 GMT

Read more ...

US stocks make slight gains as yuan and oil stabilize - WRAL.com

http://news.google.com Fri, 14 Aug 2015 14:26:15 GMT

Read more ...

How China's yuan devaluation could affect your food costs - Moneycontrol.com

http://news.google.com Sat, 15 Aug 2015 08:04:24 GMT

Read more ...

Impact on rupee from China's yuan move to be temporary: Economic adviser ... - Times of India

http://news.google.com Sat, 15 Aug 2015 09:09:00 GMT

Read more ...