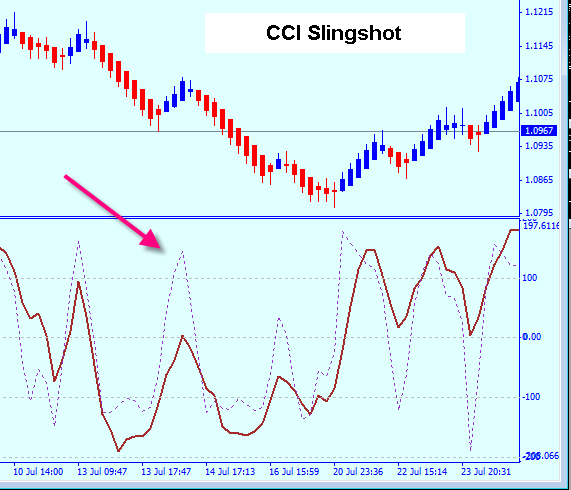

I want to demonstrate the CCI Slingshot as a Renko Trading Strategy that can be employed on a daily basis on most charts.

This one will require two indicators to make it work. First we will place a CCI14 on the chart and then overlay that with a CCI6 (the dotted line)

Note that in this example the CCI 14 has approached the 0 line before easing back while the CCI6 has approached the 100 level. It has to be this way, if the CCI6 does not get high enough the trade could be a bad entry causing a loss.

This pattern is actually a divergence between the two indicators.

See the example here

You can see that the CCI Slingshot is actually a continuation move on the trend.

This entry can be used to initiate a trade or to add to a position.

Again, all that is needed for this is two CCI indicators overlaied in a lower chart.

This example is a short pattern

Notice there is a similar pattern to the left of the one with the arrow. This one does not qualify as a CCI Slingshot because the CCI14 rose far above the zero line. That is an important aspect, the CCI14 has to rise to close to the zero line......

This Renko chart has 20 pip bars, you can see that the slingshot entries can be quite lucrative.

Of course it takes practice to see these patterns on the indicator, all entries must be 'With trend'.

If you have been looking at the posts about the Renko charts on this blog you are seeing how simple it can be to trade with Renko Bars.

There are several other Renko Trading Strategies on this blog, hopefully you will have a chance to examine those.

Boutique Trading Strategies Where We Examine Trading Strategies, Automated Trading Systems and observe fundamentals and technicals on a regular basis.

Showing posts with label trading strategies. Show all posts

Showing posts with label trading strategies. Show all posts

Monday, August 3, 2015

Renko Trading Strategies (2)

The 200 Trendline Break is another of those Renko Trading Strategies that is relatively simple to execute and appears on the charts of almost every instrument, be it forex, stocks or futures.

This trade involves using only the CCI indicator and and a trend line.

What is important is that the CCI has reached approximately 200 level from where we can draw the trend line to intersect the CCI.

Notice this example:

You can see that the line was drawn from the top of the CCI, which is close to the 200 line, and intersects where there is a bump on the CCI moving up.. When you look up at the price bars you will see that the bar is a valid entry point and that there is a relatively good move upwards.

This one will take some practice to recognize and master, however the time is well worth it as this pattern gives some excellent profits.

The 200 Trendline Break is a very simple and accurate scalping strategy

By the way, this chart is made of 20 pip Renko Bars which is my own preference. So,me people prefer smaller bars and some people prefer much larger bars.

Of course this trade can be made with short trades as well as long trades, I have only illustrated a long entry on this chart.

Again, this is a simple concept requiring only one indicator.

Please look elsewhere on this blog to see other Renko Trading Strategies.

This trade involves using only the CCI indicator and and a trend line.

What is important is that the CCI has reached approximately 200 level from where we can draw the trend line to intersect the CCI.

Notice this example:

You can see that the line was drawn from the top of the CCI, which is close to the 200 line, and intersects where there is a bump on the CCI moving up.. When you look up at the price bars you will see that the bar is a valid entry point and that there is a relatively good move upwards.

This one will take some practice to recognize and master, however the time is well worth it as this pattern gives some excellent profits.

The 200 Trendline Break is a very simple and accurate scalping strategy

By the way, this chart is made of 20 pip Renko Bars which is my own preference. So,me people prefer smaller bars and some people prefer much larger bars.

Of course this trade can be made with short trades as well as long trades, I have only illustrated a long entry on this chart.

Again, this is a simple concept requiring only one indicator.

Please look elsewhere on this blog to see other Renko Trading Strategies.

Monday, January 19, 2015

5 Simple CCI Scalping Trading Strategies (5 minute chart)

CCI Scalping is an excellent trading strategy, especially if you have some time to watch some charts for a while when trading Forex.

I have collected 5 strategies with details below and when you review each one you will see that these are simple visual strategies with indicators that you may already have or you can easily find them on the net.

Each of these can be modified a bit to suit your taste, they are easily modified or enhanced.

The most important aspect of these systems is that the chart 'talks' to you loudly so that you can see the opportunities to pick up some good pips

CCI Flash Scalping - Learn Forex Trading

http://www.learn-forextrading.org/ Tue, 02 Dec 2014 09:37:19 -0800

CCI flash scalping is a forex tradind system trend momentum very fast. A nice little 5-minute system – ideal for riding London morning session trends.

Read more ...

Forex Trading: Easy Scalping at M5 on Any Chart | Make ...

http://dollarzonline.com/ Thu, 08 Jan 2015 01:00:26 -0800

Indicators : (1) Moving Average (MA): period 14 (2) Stochastic Oscillator: Kperiod 14, Slowing 7, Dperiod 3, level 25,50,75 (3) Commodity Channel Index (CCI): period 14, level +100,0,-100 TimeFrame: M5 or higher (scalping ...

Read more ...

MQLPRO stoc/cci/VB intraday scalping system - Forex TSD

http://www.forex-tsd.com/ Sat, 02 Aug 2008 00:46:46 -0700

Hi Folks This system if followed can work for scalping It should make a good 10 pips a day .A good trader only needs to make 10 pips daily @2 lots /$20.

Read more ...

Intraday Scalping Using EMA & CCI - BabyPips.com

http://forums.babypips.com/ Sat, 27 Apr 2013 01:36:04 -0700

Hi Friends, I am effectively using EMA & CCI for scalping for the past 1 Month.The Results are encouraging. Entry made in 5 Mins chart Using 288 &a.

Read more ...

double cci and Rsioma - scalping strategy ~ ozo forex trading

http://ozofx.blogspot.com/ Tue, 24 Dec 2013 14:30:00 -0800

The best pairs to trade using this scalping strategy: EUR/USD, Aud/USD, GBP/USD. Time frame:1M and 5M. Spread max:0,00025. Timeframe : M1*M5. Indicators : 2MA crossover , Heiken ashi smothed , Rsioma , Double cci woody. Entry to ...

Read more ...

Monday, August 25, 2014

Gold Trading Strategies (as At August 25, 2014)

Gold seems to have recovered from the lows of the day as the charts show. however, there is still the pessimism based on the idea that interest rates may move higher.

The rise in the US Dollar has affected the price of Gold for two months, as you will see in the chart below, there is some divergence showing, perhaps the rise of the US Dollar is going to slow for a while

Gold holds near 2-mth low on firm dollar, talk of US rate hike - Reuters Africa

http://news.google.com Mon, 25 Aug 2014 08:21:58 GMT

CNBCGold holds near 2-mth low on firm dollar, talk of US rate hikeReuters AfricaBy Lewa Pardomuan. SINGAPORE (Reuters) - Gold edged down on Monday, hovering near its lowest in two months on a firmer U.S dollar and speculation of an eventual increase ...

CNBCGold holds near 2-mth low on firm dollar, talk of US rate hikeReuters AfricaBy Lewa Pardomuan. SINGAPORE (Reuters) - Gold edged down on Monday, hovering near its lowest in two months on a firmer U.S dollar and speculation of an eventual increase ...

Read more ...

Gold back in the red after dismal week - MarketWatch

http://news.google.com Mon, 25 Aug 2014 05:32:24 GMT

Gold back in the red after dismal weekMarketWatchLOS ANGELES (MarketWatch) — Gold got back to its losing ways after last week's positive finish, slipping on Monday as traders and central bankers continue to assess the threat of rising interest rates ...

Read more ...

I will attach two more charts that are current as I post this, showing that the decline has moderated.

It will be interesting to see which way the metal will move as it breaks out of this range.

A conservative trading strategy is needed until this range is broken.

The rise in the US Dollar has affected the price of Gold for two months, as you will see in the chart below, there is some divergence showing, perhaps the rise of the US Dollar is going to slow for a while

Gold holds near 2-mth low on firm dollar, talk of US rate hike - Reuters Africa

http://news.google.com Mon, 25 Aug 2014 08:21:58 GMT

Read more ...

Gold back in the red after dismal week - MarketWatch

http://news.google.com Mon, 25 Aug 2014 05:32:24 GMT

Gold back in the red after dismal weekMarketWatchLOS ANGELES (MarketWatch) — Gold got back to its losing ways after last week's positive finish, slipping on Monday as traders and central bankers continue to assess the threat of rising interest rates ...

Read more ...

I will attach two more charts that are current as I post this, showing that the decline has moderated.

It will be interesting to see which way the metal will move as it breaks out of this range.

A conservative trading strategy is needed until this range is broken.

Sunday, August 24, 2014

Gold Trading Strategies (as at August 24, 2014)

Two trading strategies for Gold on a 4 hour chart.

Here are two conservative strategies, each has a couple confirmations and they both give a clear picture as to what is happening with the price of Gold.

This first chart has some oscillators and a 15 sma to indicate the trend, a simple presentation.

Below are some articles about Gold and we can see from them that people are pessimistic about the price in future.

Actually, it is very difficult to know future direction of prices, many times the news has been proven to be wrong.

(Please note that nothing on this page is a recommendation to buy or sell, this is for entertainment only)

Gold set for biggest weekly drop since mid-July on rate speculation - Fox Business

http://news.google.com Sat, 23 Aug 2014 00:50:48 GMT

Wall Street JournalGold set for biggest weekly drop since mid-July on rate speculationFox BusinessGold steadied above a two-month low on Friday after a five-day losing streak and was headed for its biggest weekly loss in five, hurt by strong U.S. eco ...

Wall Street JournalGold set for biggest weekly drop since mid-July on rate speculationFox BusinessGold steadied above a two-month low on Friday after a five-day losing streak and was headed for its biggest weekly loss in five, hurt by strong U.S. eco ...

Read more ...

Gold ends lower on poor demand amid global uncertainty - Times of India

http://news.google.com Sun, 24 Aug 2014 06:53:18 GMT

Gold ends lower on poor demand amid global uncertaintyTimes of IndiaMUMBAI: Gold prices declined marginally in a lacklustre trade at the domestic bullion market here on Saturday due to lack of buying interest amid disappointing overseas trading senti ...

Read more ...

Gold To Fall Lower But Don't Expect Prices To Collapse - Capital Economics - Forbes

http://news.google.com Thu, 21 Aug 2014 20:48:21 GMT

Gold To Fall Lower But Don't Expect Prices To Collapse - Capital EconomicsForbes(Kitco News) – An improving U.S. economy and growing expectations for an early rate hike will drag gold prices lower by the end of the year, but the impact will be limite ...

Read more ...

Gold - The Week Ahead - Seeking Alpha (registration)

http://news.google.com Sun, 24 Aug 2014 08:14:37 GMT

Gold - The Week AheadSeeking Alpha (registration)Gold and relative securities had a difficult last week, due to concerning rate discussion in the FOMC meeting minutes and strong economic data stoking fear of Fed rate hike. However, Janet Yellen's dov ...

Read more ...

Here are two conservative strategies, each has a couple confirmations and they both give a clear picture as to what is happening with the price of Gold.

This first chart has some oscillators and a 15 sma to indicate the trend, a simple presentation.

The second chart has some elements of the Bill Williams system, this chart is quite conservative and also quite profitable for a longer term investor.

I like to keep an eye on the P&F charts as it gives a good idea as to where things may be headed in future. This one indicates that Gold may be in for a further decline in the short term.

Below are some articles about Gold and we can see from them that people are pessimistic about the price in future.

Actually, it is very difficult to know future direction of prices, many times the news has been proven to be wrong.

(Please note that nothing on this page is a recommendation to buy or sell, this is for entertainment only)

Gold set for biggest weekly drop since mid-July on rate speculation - Fox Business

http://news.google.com Sat, 23 Aug 2014 00:50:48 GMT

Read more ...

Gold ends lower on poor demand amid global uncertainty - Times of India

http://news.google.com Sun, 24 Aug 2014 06:53:18 GMT

Gold ends lower on poor demand amid global uncertaintyTimes of IndiaMUMBAI: Gold prices declined marginally in a lacklustre trade at the domestic bullion market here on Saturday due to lack of buying interest amid disappointing overseas trading senti ...

Read more ...

Gold To Fall Lower But Don't Expect Prices To Collapse - Capital Economics - Forbes

http://news.google.com Thu, 21 Aug 2014 20:48:21 GMT

Gold To Fall Lower But Don't Expect Prices To Collapse - Capital EconomicsForbes(Kitco News) – An improving U.S. economy and growing expectations for an early rate hike will drag gold prices lower by the end of the year, but the impact will be limite ...

Read more ...

Gold - The Week Ahead - Seeking Alpha (registration)

http://news.google.com Sun, 24 Aug 2014 08:14:37 GMT

Gold - The Week AheadSeeking Alpha (registration)Gold and relative securities had a difficult last week, due to concerning rate discussion in the FOMC meeting minutes and strong economic data stoking fear of Fed rate hike. However, Janet Yellen's dov ...

Read more ...

Wednesday, August 13, 2014

Is Macd Worthwhile For a Strategy?

Watch how I develop a trading strategy using the Macd.

There are so many ways to use the Macd.I want to develop an automated trading system which will be based onthe Macd.

I will set up Forex Strategy BuilderPro to generate a system, using the Macd as the 'seed'. The generatorin FSB Pro is free to change many aspects of the Macd as it iscreating strategies with other indicators or price conditions.

Here is a look at how I started this:

Saturday, August 9, 2014

12 Excellent Books To Enhance Your Library OF Trading Strategies

What will we use for a Trading Strategy ?

How do we know what to look for on a chart?

Where will we place our entry?

What sort of indicators will show us what we need to know?

How to we evaluate our trading strategy?

How much will this strategy produce?

How much do I stand to lose from an entry using this strategy?

Friday, August 8, 2014

Weekending Wrap Up Of Forex News

Here is a selection of news articles which may help you to digest that action of the past week and adjust your trading strategies for the coming week.

There is a lot of uncertainty in different markets as tensions appear in parts of the world.

One great thing about the forex markets is that the surprises come often and without much of a warning.

There is a lot of uncertainty in different markets as tensions appear in parts of the world.

One great thing about the forex markets is that the surprises come often and without much of a warning.

Friday Night Look At Random Trading Strategies

This has been quite a week for people and their trading strategies. Stocks have seen some movement as has the forex market.

I like to read about things on the weekend and tonight I have had a look at these articles and thought I would share them with you.

Some of these are current and some are a year or two old, each one has something to add to your knowledge.

Thursday, August 7, 2014

Bill Williams Chaos Trading Strategy Part 4 (automation)

Hopefully this is the post in the series that is going to generate some great interest in the Bill Williams trading strategy.

I will demonstrate how Forex Strategy Builder can take these three indicators, the Alligator, the Awesome Oscillator and the Gator and make them into a trading system that generates some excellent money, fully automated.

I will demonstrate how Forex Strategy Builder can take these three indicators, the Alligator, the Awesome Oscillator and the Gator and make them into a trading system that generates some excellent money, fully automated.

Bill Williams Chaos Trading Strategy Part 3

Another part of the Bill Williams trading system is the Gator which will be one of the lower indicators in your chart.

The Gator Oscillator is, in a way, similar to the Macd, in that it plots the convergence and divergence of the moving averages that form the Alligator lines. It actually demonstrates momentum.

Here are some articles to depict its use.

Wednesday, August 6, 2014

Bill Williams Chaos Trading Strategy Part 2

This is the second article on the Bill Williams 'Trading Chaos' Trading Strategy.

In this one I will present some information on the 'Awesome Oscillator' and its application.

Using the Awesome Oscillator with the Alligator Indicator can make for the building of a very powerful and yet simple trading system.

Bill Williams Chaos Trading Strategy Part 1

Bill Williams Chaos Trading Strategy

This system is used by many, many traders in all parts of the world, quite a few of those traders do very well with this strategy.

There are many aspects to this system and many interpretations as to what may be a profitable approach to this trading strategy, some of which you will agree with and some of it you may disagree with.

The first part of the system that I will like to illustrate is the alligator, the three moving averages that dominate the price chart and give a very accurate picture as to what is happening with momentum.

5 Authors Discuss Scalping As A Trading Strategy

Scalping Without Getting Skinned Alive - InformedTrades

http://www.informedtrades.com Mon, 04 Aug 2014 15:01:57 GMT

Automated scalping systems can also instantly calculate, set and modify stop-loss and profit-taking orders, so traders can better focus on analytical and administrative tasks without missing sudden price moves. Consistency is ...

Read more ...

8 Important Opinions For Your Trading Strategy

Bracket Orders & Trailing Stoploss (SL) | Z-Connect by Zerodha

http://zerodha.com Wed, 09 Apr 2014 14:52:19 GMT

If I placed a fixed stoploss and if Nifty goes to 6790 and comes back up, the stop at 6817 will stay, and even though I might have seen profit on this trade, might end up making a loss if Nifty hits my stop. .... 40 ticks means 2 points even for multiple lots say if u r taking 2 lots , then 40 ticks means 2*100=200 Rs in absolute terms? and if this is correct , that means we have to put 40 ticks only for a trailing stop loss of 2 points irrespective of no of lots of taken.. Reply. avatar.

Read more ...

Tuesday, August 5, 2014

Monday, August 4, 2014

Using Trading Signals As Your Forex Strategy

We all want to profit from our trading endeavors and the limitations we have are time and money, sometimes a trading signal is a worthwhile investment.. How best to use our resources.

There are a few things we can do to take advantage of the market and depending on our skill set we can turn opportunities into profits.

Profitable Trading Strategies With Excellent Profits

There are some excellent trading strategies available for our use developed by some great coders. I have gathered a selection of these strategies and urge you to have a look at the excellent returns provided.

Monday, July 28, 2014

Forex Strategy Builder Pro Strategy Collection Feature For Building Trading Strategies

One of the unique features of this program is to be able to collect strategies as they are created by the generator. The benefits of this feature are huge. For one thing as the different strategies evolve they can be examined in detail and information may be gleaned for developing the ultimate strategy that will be used for actual trading.

Subscribe to:Posts (Atom)