Larry Connors developed for daily charts his RSI(2) strategy, I wanted to modify it as an experiment.

Developing an EA and a portfolio of Ea’s is constant experimenting, adjusting, testing and finally real time trading.

His original specification was the RSI(2) being below 5, I changed that to 10.

One specification is that price ios to be above the 200 moving average, I retained that.

I also inserted a stop loss and a take profit as well asd using a channel for exit.

Actually the generator inserted the LSMA Channel after several hours of generating.

I chose to use the EURUSD pair and the time frame is 4 hours.

That covers the modifications.

Let’s have a look at the results.

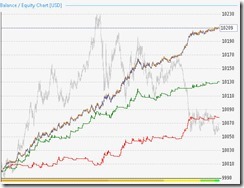

Here is the equity curve.

You can see that there is a period of stagnation that lasts for quite a long period. Of course, the specification that price has to be above the 200 ma can result in gaps, so the stagnation can be expected.

Here is some statistics

These statistics are not really impressive to me.

The System Quality Number is great at 4.40, the Equity Drawdown is also great at 0.17. Those are the good points.

Profit Factor is only 1.56, I would prefer well over 2 for this metric.

Stagnation at 686 is far more than I would like because ut is taking so long to recover from losses.

Maximum consecutive losses at 12 is not what I prefer. That means there are many losses in groups of 3 or 6 or 10 which eat the capital and take time to recover from.

Win Loss ratio at 0.32 is not satisfactory.

Here are some additional statistices. In this chart is shown the reason that I will not use this approach for trading.

You will notice in the trade distribution that the long entrieshad almost twice as many losers as winners………just the opposite for the short trades….

For that reason I will not use this strategy as I prefer there to be a relative balance.

I have been wanting to experiment with this RSI(2) system for quite a while because many people have written about it in their blogs. For me, it was quite disappointing.

However, in system research we have to try many things, try to learn and use experience for developing systems that work reliably. Some days we succeed although those days are scarce… (humor).

Tomorrow I will have another experiment.

Good Trading….

Developing an EA and a portfolio of Ea’s is constant experimenting, adjusting, testing and finally real time trading.

His original specification was the RSI(2) being below 5, I changed that to 10.

One specification is that price ios to be above the 200 moving average, I retained that.

I also inserted a stop loss and a take profit as well asd using a channel for exit.

Actually the generator inserted the LSMA Channel after several hours of generating.

I chose to use the EURUSD pair and the time frame is 4 hours.

That covers the modifications.

Let’s have a look at the results.

Here is the equity curve.

You can see that there is a period of stagnation that lasts for quite a long period. Of course, the specification that price has to be above the 200 ma can result in gaps, so the stagnation can be expected.

Here is some statistics

These statistics are not really impressive to me.

The System Quality Number is great at 4.40, the Equity Drawdown is also great at 0.17. Those are the good points.

Profit Factor is only 1.56, I would prefer well over 2 for this metric.

Stagnation at 686 is far more than I would like because ut is taking so long to recover from losses.

Maximum consecutive losses at 12 is not what I prefer. That means there are many losses in groups of 3 or 6 or 10 which eat the capital and take time to recover from.

Win Loss ratio at 0.32 is not satisfactory.

Here are some additional statistices. In this chart is shown the reason that I will not use this approach for trading.

You will notice in the trade distribution that the long entrieshad almost twice as many losers as winners………just the opposite for the short trades….

For that reason I will not use this strategy as I prefer there to be a relative balance.

I have been wanting to experiment with this RSI(2) system for quite a while because many people have written about it in their blogs. For me, it was quite disappointing.

However, in system research we have to try many things, try to learn and use experience for developing systems that work reliably. Some days we succeed although those days are scarce… (humor).

Tomorrow I will have another experiment.

Good Trading….

No comments:

Post a Comment