This is the second in a series about the “Puria Scalping Method”, the first article showed the results of automating the trading on the EURUSD currency pair, daily time frame.

You can reference that article here.

The background for this strategy can be found on that page.

Briefly, the Puria Scalping Method was developed several years ago for manual trading and I am starting to test various scenarios for automating it as it does show some promise.

I will be posting several tests as days pass and gradually narrowing down some choices to see if there is a viable approach to making an expert adviser from this Puria concept.

Today I will discuss results of a test on the AUDUSD currency pair.

For this test, I used Daily data from January 3, 2000, to April 18, 2017. I personally prefer to use daily data as well as 4-hour data for my own portfolio, hence I start off with the daily data.

Most people are going to be interested in a faster time frame, later I will work with one hour or 15 minutes to get some more interesting results for those people.

I have found that a 5-minute chart for an expert adviser requires far too much maintenance and that the higher time frames seem to have better results and require very little maintenance.

It is time now to get into the numbers for the Daily AUDUSD results for the Puria system.

I generated this one using a lot size of 0.01 and possibility of adding 0.01 or decreasing by 0.01 for subsequent signals. Please note that contract size is $10,000, instead of the normal $100,000. as that does make a significant difference.

I did not set take profit or stop loss, I left that to the generator to determine the trade exit.

In future, I may set maximum stop loss and a specific take profit so as to obtain more control over results. That may appeal to traders who would want to automate this system more than the freewheeling adviser that I have created.

Initially, the criteria used is a combination of the ma5 over ma85 and the 26,15, 1, Macd over the zero line. I do not use the simultaneous cross as those do not always line up and many entries would be missed.

The generator added two items to the mix, the exit is at the upper band of the Steady Bands and additional entry criteria, the Hull Moving average.

The Steady Bands period is 48, the margin in points is 884 and the shit is 0. I would not have ever considered those numbers, however, until the strategy proves itself in real trading, I will go along with it.

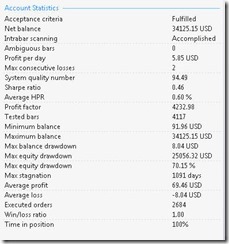

Here are some results.

You can see that Win/Loss is 1.00 which is super! System Quality number is very high at 94.49 and Profit Factor is high also.

Quite pleasing results in many areas. This one could be a keeper.

EXCEPT that, there is equity drawdown of 70 percent which is a huge turn off!

Here are the numbers regarding long and short distribution.

From this, you can see that there were only two short entries, both of them losers.

There is not much of a takeaway from this test except that there was a nice appreciation of capital for the period and that the drawdown was excessive making this one not very interesting.

Next will be some work with the faster timeframes and that will be much more rewarding.

Good Trading.!!

You can reference that article here.

The background for this strategy can be found on that page.

Briefly, the Puria Scalping Method was developed several years ago for manual trading and I am starting to test various scenarios for automating it as it does show some promise.

I will be posting several tests as days pass and gradually narrowing down some choices to see if there is a viable approach to making an expert adviser from this Puria concept.

Today I will discuss results of a test on the AUDUSD currency pair.

For this test, I used Daily data from January 3, 2000, to April 18, 2017. I personally prefer to use daily data as well as 4-hour data for my own portfolio, hence I start off with the daily data.

Most people are going to be interested in a faster time frame, later I will work with one hour or 15 minutes to get some more interesting results for those people.

I have found that a 5-minute chart for an expert adviser requires far too much maintenance and that the higher time frames seem to have better results and require very little maintenance.

It is time now to get into the numbers for the Daily AUDUSD results for the Puria system.

I generated this one using a lot size of 0.01 and possibility of adding 0.01 or decreasing by 0.01 for subsequent signals. Please note that contract size is $10,000, instead of the normal $100,000. as that does make a significant difference.

I did not set take profit or stop loss, I left that to the generator to determine the trade exit.

In future, I may set maximum stop loss and a specific take profit so as to obtain more control over results. That may appeal to traders who would want to automate this system more than the freewheeling adviser that I have created.

Initially, the criteria used is a combination of the ma5 over ma85 and the 26,15, 1, Macd over the zero line. I do not use the simultaneous cross as those do not always line up and many entries would be missed.

The generator added two items to the mix, the exit is at the upper band of the Steady Bands and additional entry criteria, the Hull Moving average.

The Steady Bands period is 48, the margin in points is 884 and the shit is 0. I would not have ever considered those numbers, however, until the strategy proves itself in real trading, I will go along with it.

Here are some results.

You can see that Win/Loss is 1.00 which is super! System Quality number is very high at 94.49 and Profit Factor is high also.

Quite pleasing results in many areas. This one could be a keeper.

EXCEPT that, there is equity drawdown of 70 percent which is a huge turn off!

Here are the numbers regarding long and short distribution.

From this, you can see that there were only two short entries, both of them losers.

There is not much of a takeaway from this test except that there was a nice appreciation of capital for the period and that the drawdown was excessive making this one not very interesting.

Next will be some work with the faster timeframes and that will be much more rewarding.

Good Trading.!!

No comments:

Post a Comment