Tuesday, January 26, 2016

Gold Analysis, Ichimoku Trading Strategy as at January 26, 2016

Labels:Gold Price, Ichimoku Kinko Hyo,Trading System

Monday, January 25, 2016

Sunday, January 24, 2016

Gold Price Technical Analysis As At January 24, 2016

Labels: Fibonacci Patterns,Gold,Gold Price, Ichimoku Kinko Hyo,Support and Resistance,technical analysis

Saturday, January 23, 2016

Friday, January 22, 2016

Divergence Trading Strategy With Renko Bars and The Awesome Oscillator

Labels:awesome oscillator, Bearish Regular Divergence, Bullish Regular Divergence,Divergence,Renko

Thursday, January 21, 2016

Ichimoku Trading Strategy

What Is Ichimoku Kinko Hyo?

Ichimoku Kinko Hyo is an approach to a trading strategy that combines a series of moving averages. While its display on a chart may be overwhelming at first glance, an experienced user can quickly determine the position of the market from the display.Lets examine the components of the Ichimoku Trading Strategy.

Labels: Chikou Span,Ichimoku, Ichimoku Kinko Hiyo,Support and Resistance,trading strategy

Wednesday, January 20, 2016

Fibonacci Patterns January 20, 2016 Crude Oil

Interesting Fibonacci Patterns on Crude Oil

Crude Oil today has taken one terrible pounding and brought world markets down by a huge amount. There is tremendous apprehension as to what will follow as the new day begins in Asia.

Some important developments are revealed on the technical charts. Have a look at these Fibonacci Patterns.

First the Daily Chart

Labels:AB=CD Pattern, Bullish Divergence, Bullish Shark Pattern,CCI Divergence, Fibonacci Patterns

Tuesday, January 19, 2016

Does Fibonacci Show A Recovery Coming For Crude Oil?

World Economy Has Been Strangled By The Price Of Crude.

Politicians around the world may be getting a break soon from their failing economies. The Fibonacci Patterns are showing that better days are coming for crude oil.

The Fibonacci Pattern shown on this chart is the very reliable AB=CD pattern and is a strong indication that the market will turn bullish.

Labels:AB=CD Pattern,Fibonacci Pattern, Fibonacci Retrace

Fibonacci Patterns as at January 19, 2016

This video shows some current Fibonacci Patterns in place as January 19, 2016.

These patterns are definitely not foolproof, however they do give an indication as to what may be occurring in the near future.

Any entry would have to be confirmed by price action or by other indicators.

Here is another video showing patterns on daily charts.

These patterns are definitely not foolproof, however they do give an indication as to what may be occurring in the near future.

Any entry would have to be confirmed by price action or by other indicators.

Here is another video showing patterns on daily charts.

Trading Strategy

A summary of Trading Strategy posts.

January 16, 2016

Renko Ichimoku Trading Strategy as at January 15, 2016

Showing some entries using the Ichimoku CloudRead More

January 4, 2016

CCI Scalping, Revisiting the CCI SlingShot

Using the CCI6 and CCI14 to make continuation entriesRead More

CCI Divergences to Have a Look At January 4, 2016

CCI Divergence EntriesReadMore

December 24, 2015

Ichimoku Renko Trading Strategy (2)

Current entries using this strategyRead More

April 5, 2014

Bill Williams Alligator (Chaos) SystemAn Introduction to this old favorite and Automated with Forex Strategy Builder

Read More

April 4, 2014

Forex Trading Strategies

An introduction into the prospective coverage areas of this blog, Trading Strategies.Read More

Bline System

An excellent Day Trading Strategy that emphasizes the usage of Stochastics

Labels: automated trading strategy,trading strategies,trading strategy

Monday, January 18, 2016

FTSE IS Showing a Bullish Alt Three Drives Pattern

Labels: Bullish Divergence,Fibonacci Pattern, FTSE Index

Saturday, January 16, 2016

Friday, January 15, 2016

Thursday, January 14, 2016

Who Needs A Trading Plan?

One of the greatest tools that a trader can use is a trading plan.

A trading plan is similar to a map. It will help us get to our goal.

The markets offer many alternatives and many distractions daily. A trading plan can be like a ship's rudder and help us to stay on course.

I have made a couple lists with some criteria that you can maybe use to evaluate and construct your trading plan.

A trading plan is similar to a map. It will help us get to our goal.

The markets offer many alternatives and many distractions daily. A trading plan can be like a ship's rudder and help us to stay on course.

I have made a couple lists with some criteria that you can maybe use to evaluate and construct your trading plan.

Labels: Trading Plan

Tuesday, January 12, 2016

Monday, January 11, 2016

15 Questions To Ask Your Broker

How Well Do You Know Your Broker?

As we go about our trading business from day to day, we probably do not pay much attention to the qualities of the broker we use.

We have little or no idea as to where their office is, where their bank is, or how safe our funds are.

We do know that the broker has a fancy website that promises all sorts of good things, and we have no idea if any of it is true.

Sunday, January 10, 2016

Gold Price Analysis As At January 10, 2016

The past week has seen a lot of fluctuation in the Gold Price and there has been news as to China purchasing a gold vault at the London Metals exchange which would indicate more participation by that country in the gold markets.

I am attaching a chart of Gold showing a bearish Shark Pattern which may be a good indication that we will see the price of the metal fall in coming days

Friday, January 8, 2016

Gold Analysis As At January 8, 2016

Which Direction For Gold? What Analysis Is Best?

With the Gold price closing today at approximately $1,104.00 many people are starting to wonder the longer term direction. There are bearish and bullish factors to be included in any analysis.

The Federal Reserve is scheduling rate increases for 2016 and those may be bearish for the Gold price.

"The United States continued to import large volumes of gold jewelry in October," Erica Rannestad, senior analyst of precious metals demand at GFMS, said in an email late on Wednesday.

16 Great Trading Books

From time to time every trader questions his trading strategy and is seeking answers as to how to improve it.

Answers are not always easy to find and we have to look outside of ourselves to find them.

Resources can be the internet or forums or our trader friends… or……. books.

I have compiled a list of books by some very well known authors which I am sharing below.

Thursday, January 7, 2016

Uproar in World Currency Markets As Yuan Is Devalued

It will be important to adjust your trading strategy this morning as world markets appear to be in a state of flux.

China has seen a deterioration in their markets and as a result has stopped trading.

European Markets seem to be weak and falling and it may well be that these conditions will prevail when New York opens as well.

China has seen a deterioration in their markets and as a result has stopped trading.

European Markets seem to be weak and falling and it may well be that these conditions will prevail when New York opens as well.

Monday, January 4, 2016

CCI Scalping, Revisiting the CCI SlingShot

A few months ago I mentioned The CCI Slingshot and there seems to be quite an interest in this trading strategy.

This formation is quite common on several time frames and can be made to be profitable with adherence to some rules.

This is a trend following trade and is used for a continuation entry.

China markets weak

Global stocks sink, China stock trading halted after share prices dive

http://www.cbc.ca/news/business/china-stock-prices-1.3388119

Shared via the CBC News Android App

http://www.cbc.ca/news/business/china-stock-prices-1.3388119

Shared via the CBC News Android App

Another Simple CCI Scalping Strategy

CCI makes an excellent scalping tool, especially if you can be patient enough to wait until a divergence shows up.

To make this a little more reliable you can add a RSI indicator to the chart and check for divergences with it also.

In this example we can use CC!7 and RSI7 and that is about all we need to locate Regular Divergences.

Keep in mind that Divergences do not always work, Stop Loss is essential.

For this type of trading I use a 15 minute chart.

Here are three examples that you can have a look at and then adapt your trading style to suit.

Again, a Stop Loss is necessary. and definitely do not ‘Bet the Farm’ using this type of method.

Labels:CCI,CCI Divergence,CCI Scalping, Regular Divergence,Scalp

CCI Divergences to Have a Look At January 4, 2016

Here are some current regular divergences you may be able to take advantage of.

I like to use the CCI regular divergences to find trend reversals, they work out much of the time.

Probably you will want to confirm by using other indicators or approaches.

Here are four charts that I located with regular divergences at this time.

There may be some opportunities with these, and certainly more CCI Divergences will appear as the day passes.

Good Trading!

Labels:CCI,CCI Divergence, CCI3, Regular Divergence

Sunday, January 3, 2016

EURUSD As At January 4, 2016

The EURUSD pair has been in a decline for a while however as the market opened today there was a slight rise as you will see on this 60 minute chart.

A lot is unknown about the direction although many people seem to be bearish as you will see in the articles I have listed below. There is a lot to consider based on the Middle East situation, interest rates in the United States and the general world economy which has not shown much in the way of advances in recent months.

The oil market is hampering many of the major economies and it seems that oil is going to maintain a depressed price level for months to come.

As the US economy continues to improve, the Dollar is rising and putting more pressure on the Euro.

Here are some comments which offer varying opinions:

EUR/USD: There's No Hiding from a Euro to Dollar Collapse - Profit Confidential

Sun, 03 Jan 2016 11:01:04 GMT

EUR/USD: There's No Hiding from a Euro to Dollar CollapseProfit ConfidentialIn turbulent times of geopolitical strife, important issues about economics get pushed into the backdrop of our perception, and that makes forecasting the EUR/USD pair diffic ...

Read more ...

EURUSD Bear Pressure Builds Up On 1.0795 Level - Forex Crunch

Mon, 04 Jan 2016 00:19:00 GMT

Read more ...

Barclays on EUR/USD for this week, and also their "Trade for the week ahead" - ForexLive

Mon, 04 Jan 2016 00:03:39 GMT

Barclays on EUR/USD for this week, and also their "Trade for the week ahead"ForexLiveFX market liquidity dropped materially into year-end, with average daily EURUSD volumes about 1/3 of their 2015 average according to our VolT data. Our data also sug ...

Read more ...

Barclays on EUR/USD for this week, and also their "Trade for the week ahead" - ForexLive

Mon, 04 Jan 2016 00:03:39 GMT

Barclays on EUR/USD for this week, and also their "Trade for the week ahead"ForexLiveFX market liquidity dropped materially into year-end, with average daily EURUSD volumes about 1/3 of their 2015 average according to our VolT data. Our data also sug ...

Read more ...

EUR/USD: Get Ready For 'Groundhog Day' - Barclays - eFXnews

Sun, 03 Jan 2016 23:23:29 GMT

EUR/USD: Get Ready For 'Groundhog Day' - BarclayseFXnews"FX market liquidity dropped materially into year-end, with average daily EURUSD volumes about 1/3 of their 2015 average according to our VolT data. Our data also suggest, however, that activity ...

Read more ...

EUR/USD Forecast Jan. 4-8 - Forex Crunch

Sat, 02 Jan 2016 11:42:11 GMT

Read more ...

EURUSD 2016 Forex Forecast January 3 2016 - DailyForex.com

Sun, 03 Jan 2016 06:00:40 GMT

Read more ...

EURUSD: Getting a Handle on December Volatility - Elliott Wave

Wed, 30 Dec 2015 21:14:41 GMT

Read more ...

Gold Price Analysis As At January 4, 2016

How Do We Determine Gold Price Direction?

The Gold Price is difficult to forecast at this time as there are many factors in play.

Gold has been trading quietly recently and any gold analysis is going to have to be a bit speculative as no direction has been established except for bearish.

Recent developments in the Middle East have triggered a rise in the market today, we will have to wait to see if it is going to be significant.

Recent developments in the Middle East have triggered a rise in the market today, we will have to wait to see if it is going to be significant.

A Technical Look at the Gold Price.

I have three charts to look at, they all show similar.

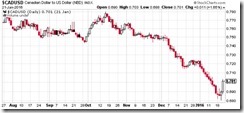

Canadian Dollar Update As At January 3, 2016

Of course the Canadian Dollar is feeling the effects of a failing economy based on someone’s dream about becoming a petrostate.

One interesting thing about petrostates is that in most of them poverty abounds.

Another interesting thing is that most petrostates are dictatorships.

And Canada was headed that way until the recent election that saw the fanatics removed from power.

Canada has a long way to go to recover from ten years of mismanagement, the current oil price has damaged all of Canada.

Here are some recent articles offering various opinions as to the future of the loonie:

CAD to USD: Why Hedge Funds See More Downside for Canadian Dollar - Profit Confidential

Sat, 02 Jan 2016 12:02:44 GMT

Read more ...

Falling oil prices and stalled economy make 2015 a year to forget - CBC.ca

Thu, 31 Dec 2015 15:25:21 GMT

Read more ...

CAD to USD: Could the Canadian Dollar Slide Another 19.0%? - Profit Confidential

Thu, 31 Dec 2015 12:01:50 GMT

Read more ...

Price of oil loses another 3%, dragging Canadian dollar back below 72 cents US - CBC.ca

Mon, 28 Dec 2015 16:31:54 GMT

Read more ...

A Nice Way To Profit From The Decline In The Canadian Dollar - Benzinga

Thu, 31 Dec 2015 13:34:00 GMT

Read more ...

Canadian dollar could sink as low as 68 cents as bond with oil grows to world ... - Financial Post

Thu, 24 Dec 2015 15:54:10 GMT

Read more ...

Labels: Canadian Dollar

Subscribe to:Posts (Atom)