Which Direction For Gold? What Analysis Is Best?

With the Gold price closing today at approximately $1,104.00 many people are starting to wonder the longer term direction. There are bearish and bullish factors to be included in any analysis.

The Federal Reserve is scheduling rate increases for 2016 and those may be bearish for the Gold price.

"The United States continued to import large volumes of gold jewelry in October," Erica Rannestad, senior analyst of precious metals demand at GFMS, said in an email late on Wednesday.

Gold has had a move higher in the past few days and then, today eased back. However, the result is a higher price than last week.

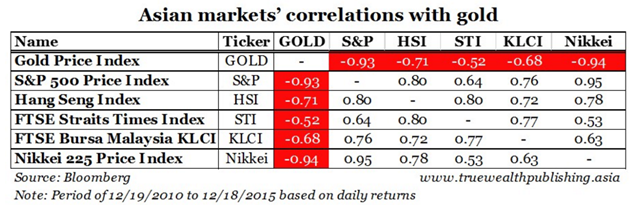

As this chart from Bloomberg shows, Gold is correlated with the Asian markets, as Asian markets rise, Gold falls and vice versa.

Technicals

These charts are using the Ichimoku Cloud, Harmonics to show Resistance and the Commodity Channel Index to show Divergence.I have a couple charts here.

Price has met resistance as it tries to move through the Ichimoku Cloud. We will see next week if there is going to be momentum to rise further.

Similarly price has retreated from the Harmonic line.

This Commodity Channel Index chart shows a couple Bullish Divergences which were probably a clue to the rise in price.

One more chart should be added here, a chart showing a Bearish Fibonacci Pattern. We may see a reversal in the next day or two based on this pattern.

Summary

The jury is still out regarding the direction for Gold Price, however there seems to be a bearish attitude at this time. The rise in the past few days seems to reflect the correlation with Asian Indices, traders running for cover as the Chinese markets fluctuate.The daily charts show a double bottom which may indicate that a rise is about to occur, however, it is too early to know if it will be significant move.

A couple articles with some further insights into Gold.

Gold price: fears the 'safe-haven' rally is over - The Week UK

Fri, 08 Jan 2016 11:04:28 GMT

Anxious Over Global Market Turmoil? Here Are Your Best Gold Investments Now - TheStreet.com

Fri, 08 Jan 2016 18:14:00 GMT

Gold slides, but scores best weekly gain in over 4 months - MarketWatch

Fri, 08 Jan 2016 19:49:00 GMT

Silver Seen Beating Gold as Ratio Rises to Near Historical Peaks - Bloomberg

Fri, 08 Jan 2016 12:36:56 GMT

Silver Seen Beating Gold as Ratio Rises to Near Historical PeaksBloombergGold has fared better this week as global market turmoil and geopolitical tension in the Middle East and Asia prompted investors to seek a haven. Silver has lagged because industrial uses account for half of its demand, compared with about 10 percent ...and moreᅠ»

No comments:

Post a Comment