Using this tool can greatly enhance your Trading Strategy

I want to share with you today one specific feature of the FSBPro software, the optimizer. I believe that you will be amazed at the capabilities of this tool, I will attempt to demonstrate.

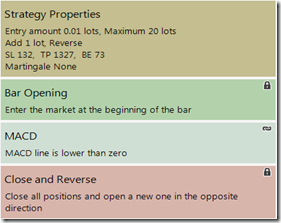

We will start with a randomly generated strategy which uses the Macd and a close and reverse option, meaning that each time the Mac crosses zero, the trade is closed and another entered going the opposite direction. No special reason for this strategy, I just wanted to have something to work with.

Here is the strategy as it is after generating for a few minutes

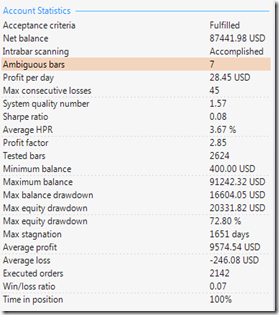

You can see that the balance is shown as 87,442. I am going to use the optimizer and see what happens when I optimize for a higher net.

This result may be entirely unsatisfactory based on other metrics, such as Win/Loss or Sharpe Ratio or…. Once this run is finished we will have a look at other metrics to see what can be improved..

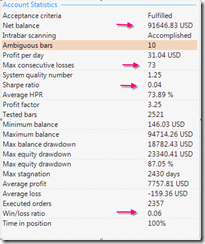

Here is some results from optimizing for Net Profit

There was a gain in the net profit, but looking at some other metrics, this result is horrible. Notice the win loss and consecutive losses.

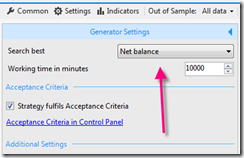

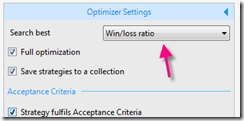

I will optimize the win loss, you can see the setting in the diagram.

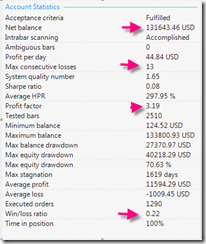

I was able to improve the Win/Loss as well as the Net Profit, also the consecutive losses was reduced considerably

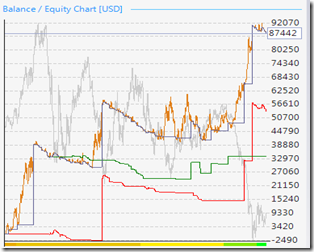

I do have a concern that the losses are awkward to deal with, I will now attempt to improve the Sharpe Ratio. I can see that I am going to have a problem with the equity curve, it is just not going to end up satisfactory.

After playing with the controls and attempting different things, I could see that the equity curve was not going to be satisfactory and I have discarded the strategy.

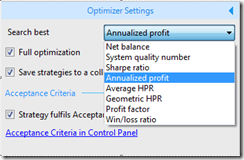

Here are the metrics on which the optimizer will work.

As you can see this optimizer is quite powerful.

I will work with a new strategy and post developments, hopefully better results than this.

Here are a couple more posts referring to Forex Strategy Builder.

http://boutiquetradingstrategies.blogspot.ca/2014/08/is-macd-worthwhile-for-strategy.html

http://boutiquetradingstrategies.blogspot.ca/2014/04/trading-strategy-based-on-bill-williams.html

http://boutiquetradingstrategies.blogspot.ca/2014/08/bill-williams-trading-strategy-part-4.html