3 Looks at Gold Technical Analysis: Ichimoku, Fibonacci Patterns, Support and Resistance

Ichimoku Kinko Hyo

This is a Daily Chart of Gold and you can see that Gold Price is trapped within the Ichimoku Cloud.

Please note that the light blue lines represent support and resistance. Gold is surrounded by support and resistance, it is going to be a battle to break theorugh all these levels to rise or fall. Until price is clear of the Ichimoku Cloud, it will be hard to make entries on this chart.

This is a 4 hour chart of Gold, the price has risen above the Kumo (Ichimoku Cloud) and you can see that it has met resistance. Looking back 26 bars at the Chikou Spsn, we see that the Chikous Span is still within the cloud, resistance. Gefinitely Gold is not ready for an entry, based on Ichimoku Kinko Hyo Charts

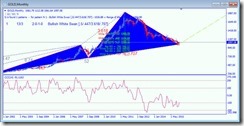

Fibonacci Patterns

On the Monthly Gold Chart we have a stron looking Bullish White Swan Dating Back to early 2001, which indicates this to be a strong bullish pattern. We can assume that the main direction in future will be bullish based on this pattern

On the weekly chart is a Bullish AB=CD Fibonacci Pattern which has actually proven to be accurate as price has risen, albeit slowly, since the pattern appeared in November 2015.

Late in November 2016 appeared a Bullish AB=CD Fibonacci Pattern on the Daily Chart and there has been an advance since the pattern appeared. Trend since that pattern appeared has been bullish although a lot of resistance.

Support and Resistance

There are a few ways to determine support and resistance levels, this one uses Harmonics. It shows the levels in a little bit different manner than the Ichimoku Chikou span, perhaps it is good to look at both charts to get a good interepretation of where these levels may be.

Summary

Gold is still deciding which way to go and at present is stuck within a range. no trend apparent.News

I have gathered a couple articles which you may find of interest.

Gold Is Back in Fashion After a $15 Trillion Global Selloff - Bloomberg

Sun, 24 Jan 2016 21:16:45 GMT

Flexible norms to make gold scheme glitter - The Hindu

Sun, 24 Jan 2016 19:08:01 GMT

Are Gold Bugs Coherent? - ValueWalk

Sun, 24 Jan 2016 20:50:00 GMT

Gold In A Non-Zero Interest Rate World - Seeking Alpha

Sun, 24 Jan 2016 12:02:10 GMT

Currency reset is more likely than China to goose the gold price - Gold Seek

Sun, 24 Jan 2016 17:42:00 GMT

"I know there's little chance GATA would ever say 'uncle,' but I'm sure that no followers of GATA would mind if you said simply, 'Wake us up when the Chinese take control of the price of gold.' For that seems to be the only counter to all the price ...

No comments:

Post a Comment