Many investors wonder if margin can day trade using their Tax-Free Savings Account (TFSA) in order to potentially earn high returns. In this article, we will discuss the rules and regulations surrounding day trading with a TFSA account and whether it is a suitable strategy for your investment goals.

Table of Contents

- What is a TFSA Account?

- Can You Day Trade with a TFSA Account?

- Pros and Cons of Day Trading with a TFSA Account

- Tax Implications of Day Trading in a TFSA Account

- Strategies for Day Trading in a TFSA Account

- Risk Management for Day Trading in a TFSA Account

- Conclusion

What is a TFSA Account?

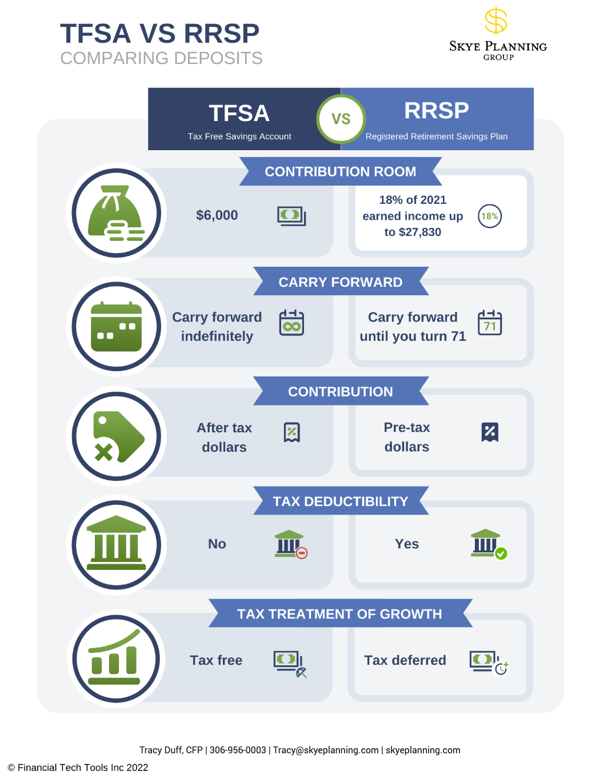

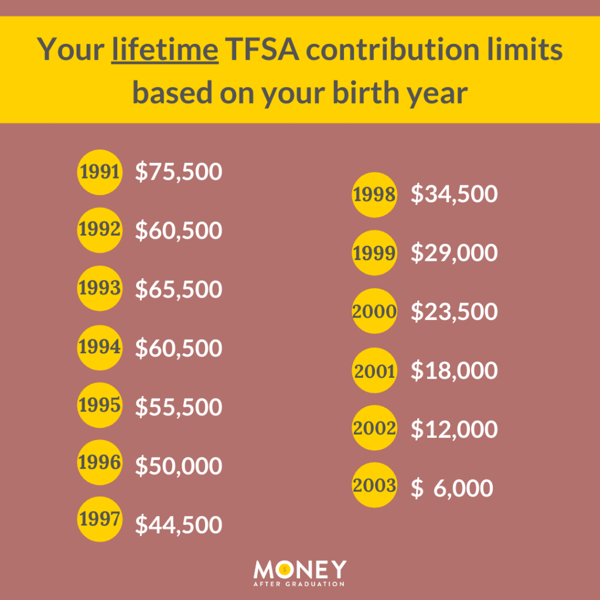

A Tax-Free Savings Account (TFSA) is a registered account that allows Canadians to earn tax-free investment income. Contributors can deposit up to a specified annual limit into their TFSA account, and any investment income earned within the account is tax-free.

Can You Day Trade with a TFSA Account?

While day trading is technically allowed in a TFSA account, there are restrictions and regulations that investors need to be aware of. The Canada Revenue Agency (CRA) may view excessive day trading activity within a TFSA account as running a business, which could result in tax consequences.

Trading within a Tax-Free Savings Account (TFSA) can be a bit tricky when it comes to day trading. While the Canada Revenue Agency (CRA) does not have specific rules against day trading within a TFSA, they do have guidelines on what constitutes "business income" as opposed to "investment income."

Day trading frequently and making significant profits could be seen as running a business by the CRA, and this could lead to penalties or taxes being imposed on your TFSA account. It's important to remember that the primary purpose of a TFSA is for long-term saving and investing, not for frequent and speculative trading.

Ultimately, the decision to day trade within a TFSA is a personal one, but it's important to be aware of the potential risks and consequences. It's recommended to consult with a financial advisor or tax professional before engaging in day trading activities within your TFSA account.

Pros and Cons of Day Trading with a TFSA Account

Day trading with a TFSA account can offer potential high returns due to the tax-free nature of the account. However, it also comes with risks, including the possibility of incurring taxes if the CRA deems the activity as business income rather than investment income.

Pros:

- Tax-Free Gains: Any profits made from day trading within a TFSA account are tax-free.

- Flexible Investment Options: TFSA accounts offer a wide range of investment options, allowing day traders to diversify their portfolios.

- No Contribution Limits: Unlike RRSP accounts, there are no annual contribution limits for TFSA accounts, providing more flexibility for day traders.

Cons:

- Risk of Losses: Day trading is inherently risky, and traders may incur significant losses if they are not careful.

- Market Volatility: The stock market can be volatile, leading to unpredictable outcomes for day traders.

- Trading Restrictions: Some TFSA accounts may have restrictions on day trading activities, limiting the potential for profits.

Overall, day trading with a TFSA account can be a viable option for investors looking to maximize their tax benefits and diversify their portfolios. However, it is important to weigh the potential risks and rewards before engaging in day trading activities.

Can you day trade with a TFSA account? While day trading is allowed within a TFSA account, it is important to be aware of the risks involved and to adhere to any trading restrictions that may be in place.

Tax Implications of Day Trading in a TFSA Account

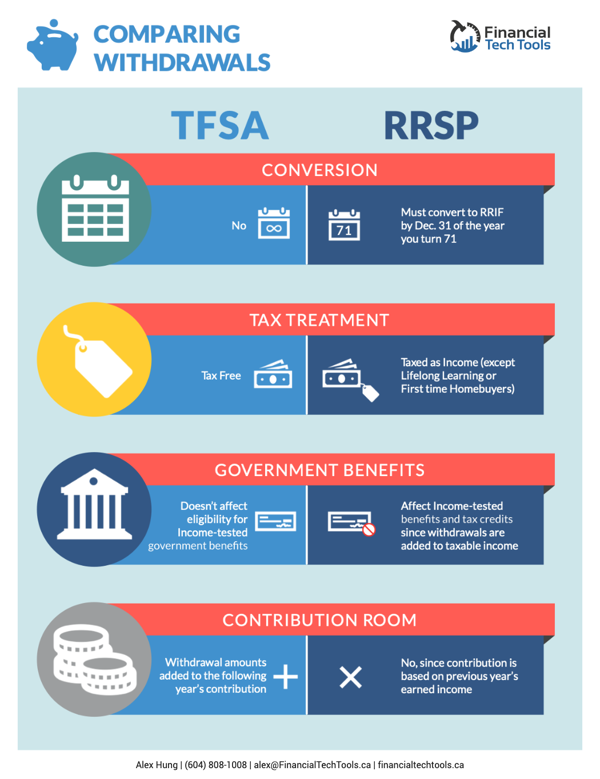

Investors should be aware of the tax implications of day trading in a TFSA account. While gains within the account are tax-free, the CRA may view frequent day trading as business income, which could be subject to taxation.

Day trading in a Tax-Free Savings Account (TFSA) can have tax implications depending on the frequency and volume of your trades. In Canada, TFSA accounts are designed to provide tax-free growth on investments, but day trading can potentially trigger the Canada Revenue Agency (CRA) to consider your TFSA as a business account.

If the CRA deems your TFSA as a business account due to frequent day trading activity, you may be subject to income tax on your gains, potentially losing the tax-free status of your TFSA. It's important to consult with a tax professional to understand the potential implications and risks of day trading in a TFSA account.

Can you day trade with a TFSA account?

While it is technically allowed to day trade in a TFSA account, it's important to be aware of the potential tax consequences and risks involved. It's recommended to use your TFSA account for long-term investing and to consult with a financial advisor before engaging in day trading activities.

Strategies for Day Trading in a TFSA Account

Investors should develop a solid trading strategy when day trading in a TFSA account to mitigate risks and maximize returns. This may include setting stop-loss orders, diversifying investments, and conducting thorough research before making trades.

Risk Management for Day Trading in a TFSA Account

Day trading in a TFSA account comes with inherent risks, including the potential for significant losses. It is important for investors to practice proper risk management techniques, such as setting stop-loss orders and diversifying their investment portfolio, to protect their capital.

Conclusion

Day trading with a TFSA account can be a high-risk, high-reward strategy for investors. It is important to understand the rules and regulations surrounding day trading in a TFSA account, as well as the potential tax implications. Investors should carefully consider their risk tolerance and investment goals before engaging in day trading with a TFSA account.

Key Takeaways

- Day trading with a TFSA account is technically allowed, but investors should be aware of the risks and regulations.

- Investors should develop a solid trading strategy and practice proper risk management techniques when day trading in a TFSA account.

- Tax implications may apply if the CRA deems day trading activity in a TFSA account as running a business.

FAQ

Q: Can I day trade in my TFSA account?

A: Day trading is technically allowed in a TFSA account, but investors should be aware of the risks and potential tax implications.

Q: What are the tax implications of day trading in a TFSA account?

A: While gains within a TFSA account are tax-free, the CRA may view frequent day trading as business income, which could be subject to taxation.

No comments:

Post a Comment