Table of Contents:

- What is a Margin Account?

- Day Trading Definition

- Day Trading with a Margin Account

- Risks and Rewards of Day Trading on Margin

- Rules and Regulations

- Understanding Margin Calls

- Benefits of Margin Trading for Day Traders

What is a Margin Account?

A margin account is a type of brokerage account in which the investor is allowed to borrow funds to invest in securities. This leverage can amplify gains, but it also increases the risk of losses.

Day Trading Definition

Day trading involves buying and selling financial instruments within the same trading day. Day traders often use margin accounts to maximize their trading potential by leveraging borrowed funds.

Day trading is a type of trading where individuals buy and sell financial instruments within the same trading day. The goal of day trading is to profit from small price fluctuations in highly liquid markets.

Can You Day Trade with a Margin Account?

Yes, it is possible to day trade with a margin account. A margin account allows traders to borrow funds from their broker in order to trade with more capital than they have in their account. This can amplify both gains and losses, so it is important for day traders to have a solid risk management strategy in place.

Day Trading with a Margin Account

Day trading with a margin account allows traders to take advantage of intraday price movements by using leverage to increase their buying power. This can lead to higher potential profits, but also higher potential losses.

Risks and Rewards of Day Trading on Margin

The main risk of day trading on margin is the potential for significant losses if the trade goes against you. However, the potential rewards can be substantial if the trader is successful in their predictions and manages risk effectively.

Rules and Regulations

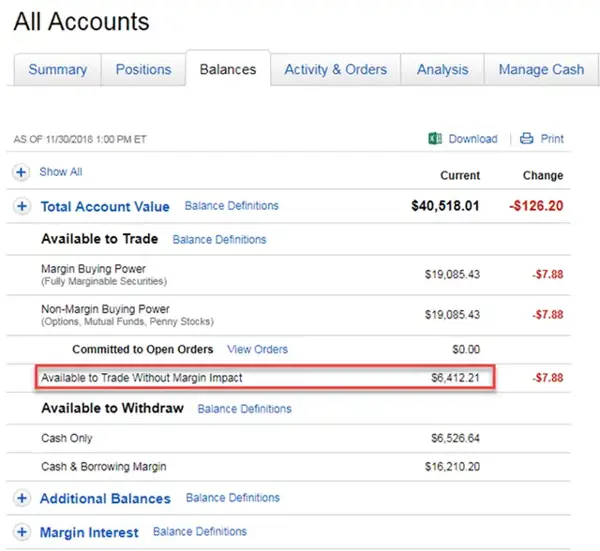

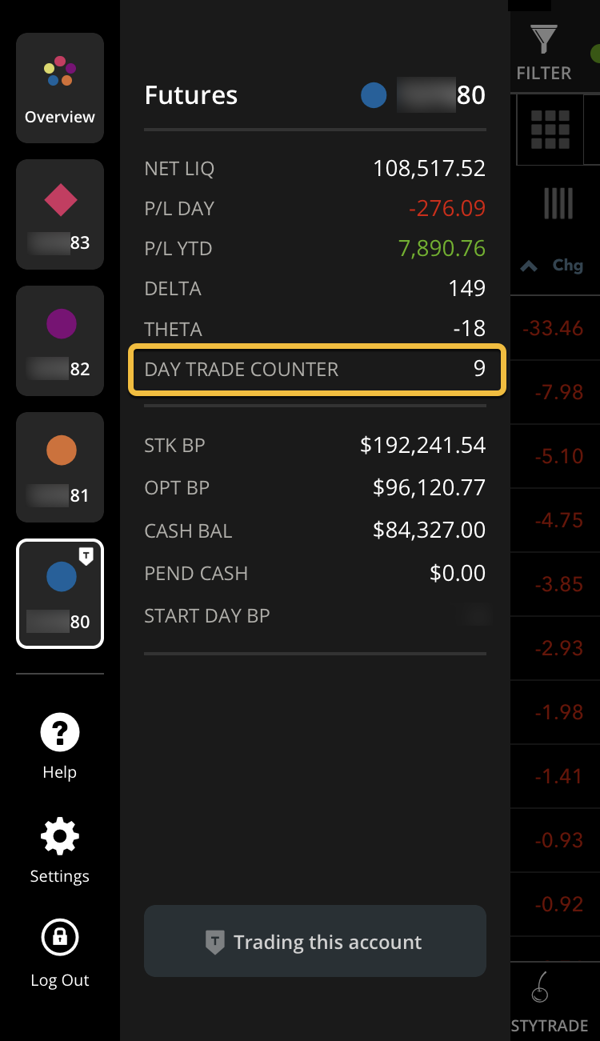

Day traders using margin accounts must adhere to specific rules and regulations set by regulatory bodies to protect investors and maintain market stability. These rules often include restrictions on the amount of leverage current can be how much cash deposited account balance required.

Understanding Margin Calls

A margin call occurs when the account value falls below a certain threshold, triggering the broker to demand additional funds to cover the losses. Failure to meet a margin call can result in the liquidation of assets to cover the shortfall.

Benefits of Margin Trading for Day Traders

Despite the risks involved, margin trading can provide day traders with increased flexibility and the ability to take advantage of short-term opportunities in the market. With proper risk management, margin accounts can be a powerful tool for active traders.

Key Takeaways:

- Day trading with a margin account allows for increased leverage and buying power.

- Using margin accounts for day trading carries significant risks, including potential losses and margin calls.

- Traders must adhere to rules and regulations governing margin trading to protect themselves and maintain market stability.

Frequently Asked Questions:

Can I day trade with a cash account?

Yes, but with limitations on the number of day trades you can make in a rolling five-day period.

What is the minimum account balance for day trading on margin?

This varies by brokerage firm and regulatory requirements, but typically ranges from $2,000 to $25,000.

How can I manage the risks of day trading on margin?

Implementing proper risk management strategies, such as setting stop-loss orders and maintaining sufficient capital reserves, can help mitigate the risks of margin trading.

No comments:

Post a Comment