Table of Contents

- Introduction

- Understanding Dow Futures

- Pre-Market Trading Hours

- Regular Trading Hours

- Factors Influencing Dow Futures Trading

- Key Takeaways

- FAQ

Introduction

Welcome to our comprehensive guide on Dow Futures trading hours. In this article, we will delve into the intricacies of the Dow Futures market, including its trading hours, importance, and factors affecting its movements.

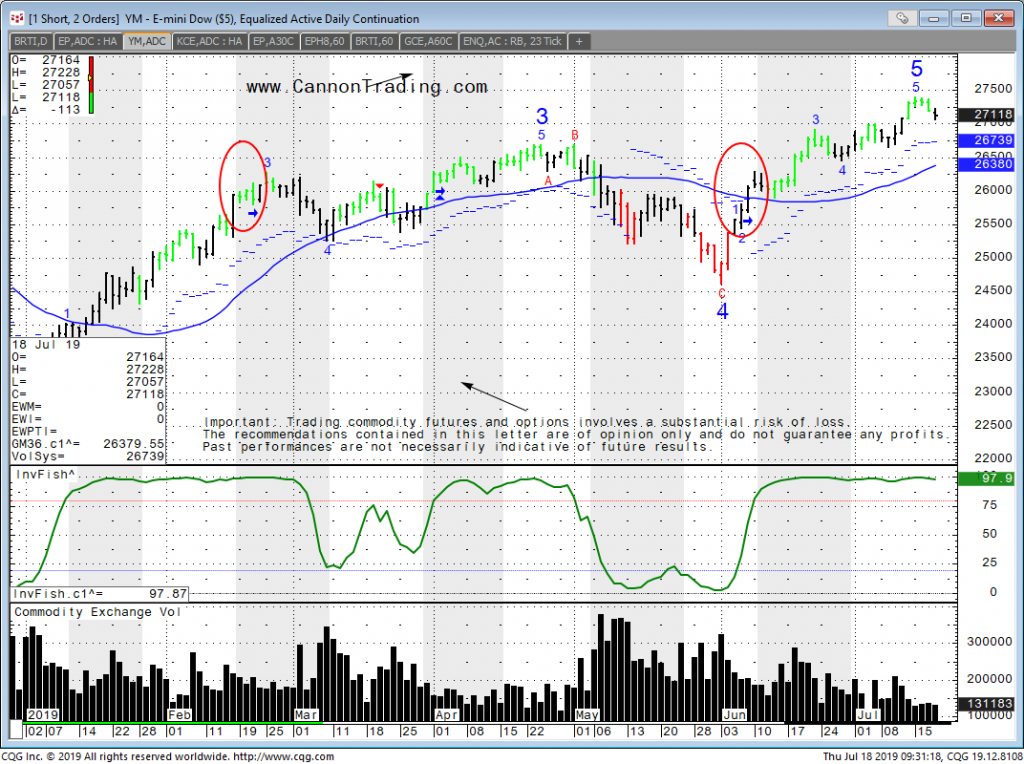

Understanding Dow Futures

Dow Futures is an index futures contract, enabling traders to speculate on the future value of the Dow Jones Industrial Average (DJIA). By trading these futures, investors can take positions on the direction of the stock market.

Pre-Market Trading Hours

The pre-market trading session for Dow Futures begins at 4:00 a.m. Eastern Time (ET) and extends until the regular trading hours start at 9:30 a.m. ET. This period allows traders to react to overnight news, global events, and economic releases before the regular session begins.

Dow Futures refer to the futures contracts based on the Dow Jones Industrial Average (DJIA). These contracts allow investors to speculate on the future price movements of the DJIA. To cater to the needs of global traders, Dow Futures trading is not limited to regular trading hours only.

The regular trading hours for the DJIA are from 9:30 AM to 4:00 PM Eastern Time (ET) in the United States. However, Pre-Market Trading hours are available for traders who wish to engage in Dow Futures trading before the regular trading session begins.

Pre-Market Trading hours for Dow Futures start as early as 4:00 AM ET and last until the regular trading hours commence at 9:30 AM ET. This extended trading session allows investors to react to important news or events that may have occurred outside regular trading hours and have an impact on the market.

During Pre-Market Trading, investors can place orders to buy or sell Dow Futures contracts just like they would during regular trading hours. However, it is important to note that trading volume during the Pre-Market session is generally lower than regular trading hours, and the bid-ask spread might be wider.

Participating in Pre-Market Trading hours for Dow Futures requires access to a brokerage platform or an online trading account that offers this extended trading feature. It is advisable to check with your specific brokerage or financial institution to ensure that you have access to these trading hours and understand any associated fees or requirements.

In conclusion, Pre-Market Trading hours for Dow Futures provide investors with the opportunity to react to market events and take advantage of early trading opportunities before the regular trading session begins. Understanding the timing and availability of these extended trading hours can be beneficial for traders looking to actively engage in Dow Futures trading.

Regular Trading Hours

The regular trading hours for Dow Futures are from 9:30 a.m. ET to 4:00 p.m. ET. During these hours, traders actively participate in the market, executing trades based on various strategies, news, and market trends. This session provides the highest liquidity and is influenced by market sentiment and economic data.

The Dow Futures trading market operates during specific hours known as Regular Trading Hours (RTH). These hours refer to the period when investors can actively trade Dow Futures contracts on designated exchanges.

Overview of Dow Futures

Dow Futures are futures contracts based on the Dow Jones Industrial Average (DJIA). The DJIA represents a selection of 30 major American companies' stocks and is widely considered a key indicator of the overall health of the stock market.

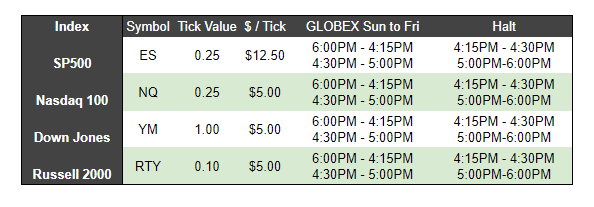

Trading Schedule

The Regular Trading Hours for Dow Futures typically begin at 5:00 p.m. Eastern Time (ET) on Sunday and continue until 4:15 p.m. ET on Friday. However, it's important to note that there is a brief daily maintenance period when the market is temporarily closed. This maintenance period typically lasts for 15 minutes at the end of each trading day, excluding weekends.

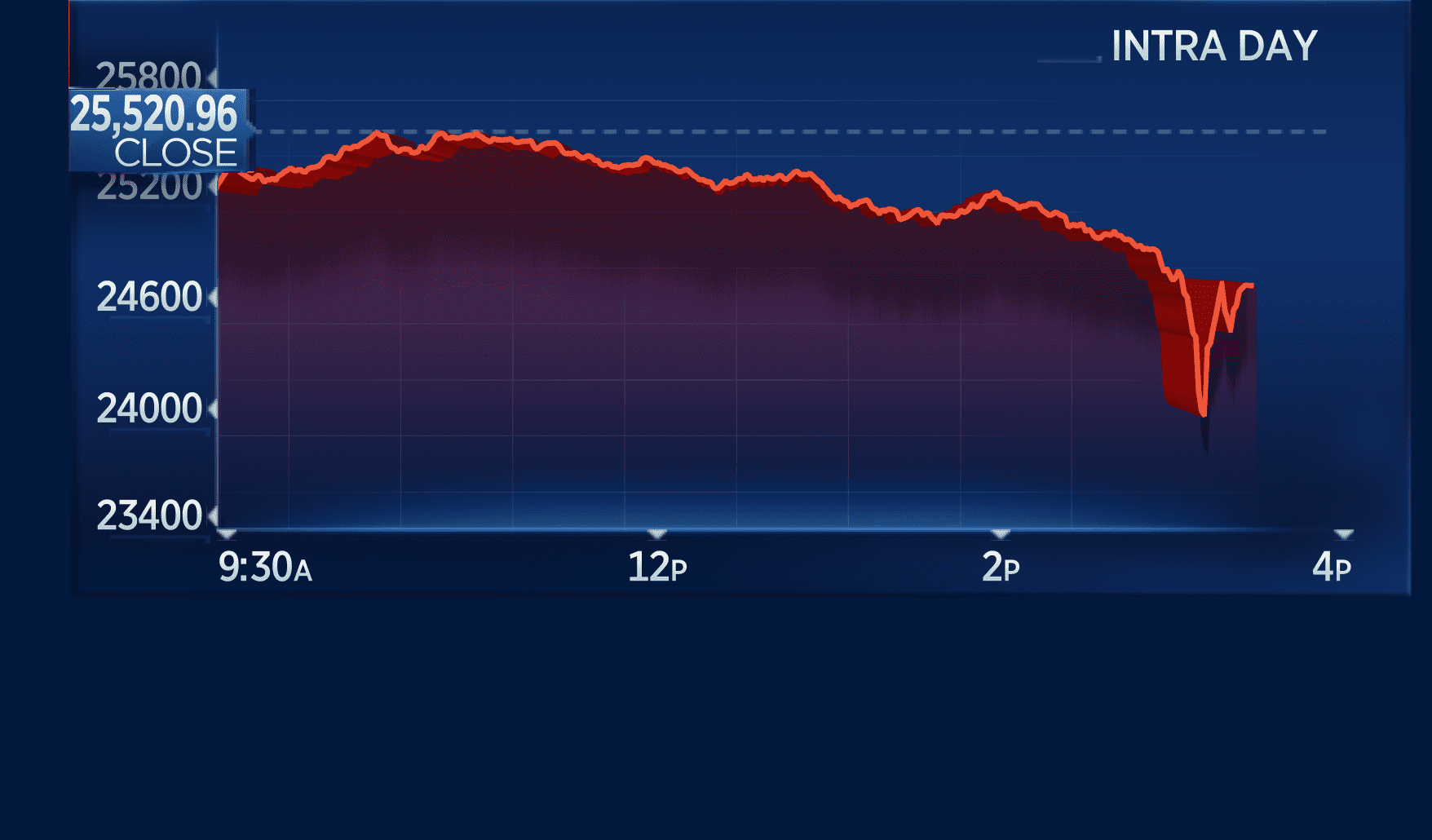

After-Hours Trading

Beyond Regular Trading Hours, there is also the option of after-hours trading for Dow Futures. After-hours trading refers to the extended trading hours available outside the Regular Trading Hours. During this time, investors can continue trading Dow Futures contracts, albeit with some limitations and potentially higher volatility due to reduced liquidity.

Understanding Time Zones

It's important to keep in mind that trading hours may vary based on the time zone you are in. Therefore, always make sure to convert the times mentioned above according to your local time zone to avoid any confusion.

Risks and Considerations

Before engaging in Dow Futures trading, it is essential to understand the risks involved and consider your investment goals, risk tolerance, and market conditions. Consulting with a financial advisor or doing thorough research can help you make informed decisions.

Factors Influencing Dow Futures Trading

The Dow Futures market is affected by numerous factors, such as:

- Macroeconomic indicators like GDP, inflation rates, and employment figures

- Company earnings reports and announcements

- Global political events and economic policies

- Changes in interest rates

- Volatility in other financial markets

Factors Influencing Dow Futures Trading

Dow Futures trading, which refers to the buying and selling of contracts for future delivery of the Dow Jones Industrial Average (DJIA), is influenced by several key factors:

- Macroeconomic Indicators: Factors such as GDP growth, inflation rates, unemployment rates, and interest rates impact investor sentiment and subsequently affect Dow Futures trading.

- Corporate Earnings: The earnings reports of companies listed on the Dow Jones Industrial Average play a crucial role in shaping market expectations and can drive significant movements in Dow Futures prices.

- Geopolitical Events: Political and economic developments around the world, such as trade disputes, conflicts, and policy changes, can cause volatility in Dow Futures trading.

- Market Sentiment and Investor Confidence: Market sentiment and investor confidence can greatly impact Dow Futures trading as positive or negative sentiments can lead to buying or selling pressure.

- Global Market Conditions: Movements in international markets, including foreign stock exchanges, currency markets, and commodity markets, can influence Dow Futures trading due to intermarket correlations.

Dow Futures Trading Hours

The Dow Futures trading hours are as follows:

- Regular Trading Hours (RTH): Dow Futures contracts trade from Sunday evening at 6:00 PM Eastern Time (ET) until Friday afternoon at 5:00 PM ET with a one-hour break each day from 5:00 PM to 6:00 PM ET.

- Extended Trading Hours (ETH): In addition to the regular trading hours, Dow Futures can also be traded during extended trading hours from Sunday to Friday. ETH sessions typically begin at 6:00 PM ET and end at 9:30 AM ET the following morning.

It's important to note that trading hours may vary based on specific trading platforms and changes in market regulations. Traders should always verify the trading hours with their chosen brokerage or exchange.

Key Takeaways

- Dow Futures enable traders to speculate on the future value of the Dow Jones Industrial Average.

- The pre-market session starts at 4:00 a.m. ET, providing traders with an opportunity to react to news and events before regular trading hours begin at 9:30 a.m. ET.

- The regular trading session runs from 9:30 a.m. ET to 4:00 p.m. ET, offering the highest liquidity and influenced by market sentiment and economic data.

- Several factors, including economic indicators, earnings reports, and global events, influence Dow Futures trading.

FAQ

- Q: Can I trade Dow Futures 24/7?

A: No, Dow Futures have specific trading hours. The pre-market session starts at 4:00 a.m. ET, and the regular trading session ends at 4:00 p.m. ET. Trading outside these hours is not possible. - Q: What are the advantages of trading Dow Futures?

A: Trading Dow Futures provides several advantages, including leverage, flexibility, liquidity, and the ability to profit from both upward and downward market movements. - Q: How can I access Dow Futures?

A: To access Dow Futures, you need an account with a brokerage firm that offers futures trading. Once you have an account, you can trade Dow Futures through their trading platform.

No comments:

Post a Comment