Table of Contents

- Introduction

- Definition of Futures Trading Month Codes

- Significance in Futures Trading

- Understanding the Code Chart

- Common Futures Trading Month Codes

- Contract Expiry and Rollover

- Importance of Futures Trading Month Codes

Introduction

Welcome to the intriguing world of futures trading month codes! In this article, we delve into the intricacies of futures contracts and how these codes represent different contract months in the financial markets.

Definition of Futures Trading Month Codes

Futures trading month codes are abbreviated symbols used to identify specific contract months of futures contracts. They help traders quickly recognize and differentiate between various delivery periods of the underlying asset in a futures contract.

Futures trading month codes are alphabetic symbols used in futures trading to represent specific delivery months for contracts. Each letter corresponds to a specific month.

Understanding the Codes

Month codes are essential for traders to determine the maturity and delivery months of futures contracts. By using these codes, traders can easily identify when a contract is set to expire or be delivered.

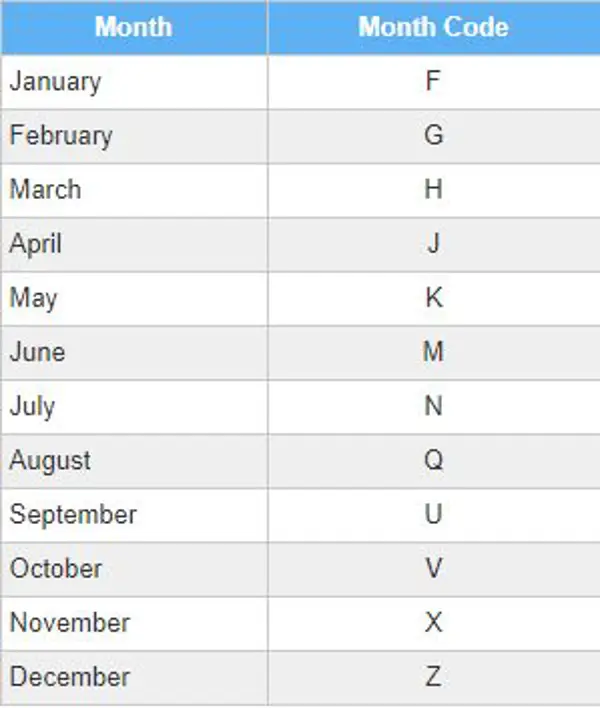

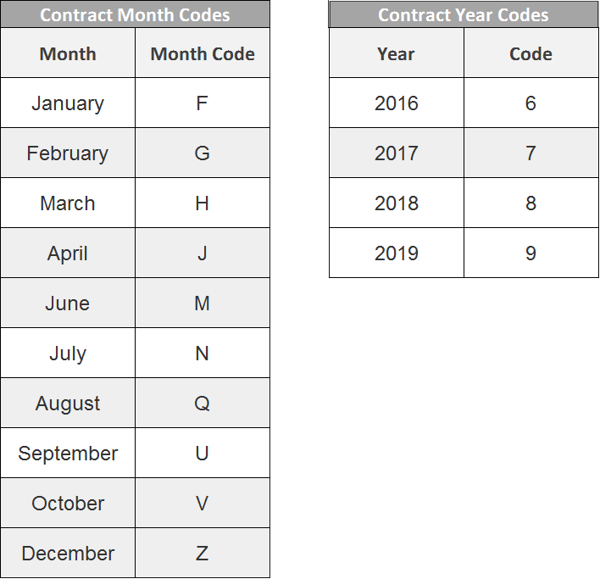

The Month Code Table

Here is a commonly used month code table in futures trading:

| Code | Month |

|---|---|

| F | January |

| G | February |

| H | March |

| J | April |

| K | May |

| M | June |

| N | July |

| Q | August |

| U | September |

| V | October |

| X | November |

| Z | December |

Usage Example

For instance, if a futures contract has the code "Z", it represents the delivery month of December. This allows traders to easily identify and track contracts based on their expiration and delivery dates.

Understanding and using futures trading month codes is essential for effective trading and managing futures contracts. These codes simplify the process of identifying contract months and are widely used in the industry.

Significance in Futures Trading

Understanding futures trading month codes is crucial for market participants as they facilitate the organization and tracking of contracts within a specific commodity or financial instrument. By using standardized codes, traders can effectively communicate and execute their strategies while navigating the complex world of futures trading.

In futures trading, month codes are used to represent different months in a futures contract's expiration date. These codes have a significant role in facilitating efficient trading and standardized contract terms.

Standardized Contract Expiration Dates

By assigning unique month codes to different months, futures exchanges ensure uniformity and clarity in contract expiration dates. Each code represents a specific month, making it easier for traders to understand and trade futures contracts with accurate expiry dates.

International Consistency

Month codes in futures trading have international significance. They allow traders across different countries to easily communicate and understand the expiration dates of futures contracts. This consistency fosters global trading and helps create a level playing field for participants worldwide.

Identification of Delivery Months

Month codes serve as a simple yet effective way to identify the delivery months for specific futures contracts. Traders can refer to these codes to determine the time period in which a contract can be settled, allowing them to align their trading strategies accordingly.

Reduced Ambiguity and Errors

Using month codes minimizes the chances of confusion, ambiguity, and errors in futures trading. Traders can clearly identify the expiration months without any room for misinterpretation, enhancing transparency and accuracy in contract negotiations and settlements.

Efficient Trade Execution

By employing month codes, traders can quickly assess the expiry date of a futures contract, aiding them in executing trades more efficiently. This allows market participants to make timely and informed decisions, maximizing trading opportunities.

Inclusion of Additional Information

Some futures exchanges utilize month codes to provide additional information about a contract's characteristics. For instance, codes may indicate specific settlement procedures, trading hours, or contract modifications. Traders can utilize this supplementary information for comprehensive understanding and strategizing.

Overall, the significance of month codes in futures trading lies in their ability to ensure standardized contract terms, international consistency, and streamlined trading operations. These codes contribute to transparent, efficient, and effective futures trading across global markets.

Understanding the Code Chart

A code chart is a key reference tool that lists the different futures trading month codes and their corresponding contract months. It provides traders with a standardized system for easily identifying specific delivery months throughout the year.

In futures trading, it is essential to understand the code chart used to represent different months. This code chart helps traders identify the delivery months for specific contracts.

Code Chart

Here is a simplified version of the code chart:

- F - January

- G - February

- H - March

- J - April

- K - May

- M - June

- N - July

- Q - August

- U - September

- V - October

- X - November

- Z - December

Example

Let's take an example to illustrate how the code chart works. If we encounter the code "V" in a futures trading contract, it corresponds to the month of October.

Why is it important?

Understanding the code chart is crucial as it helps traders identify the specific month associated with a futures trading contract. It ensures that traders are aware of the delivery months for their contracts, enabling them to make informed decisions and execute trades accordingly.

Mastering the code chart for futures trading month codes is vital for any trader in this market. It allows for accurate identification of delivery months and facilitates successful trading.

Common Futures Trading Month Codes

Here are some frequently used futures trading month codes:

- F: Represents January

- G: Represents February

- H: Represents March

- J: Represents April

- K: Represents May

- M: Represents June

- N: Represents July

- Q: Represents August

- U: Represents September

- V: Represents October

- X: Represents November

- Z: Represents December

Contract Expiry and Rollover

As the contract expiry approaches, traders need to be aware of the rollover process. Rollover involves closing out positions in the expiring contract month and simultaneously initiating new positions in the succeeding month. Understanding the futures trading month codes is vital for successful contract rollover to avoid any unintended position liquidations.

Importance of Futures Trading Month Codes

The proper interpretation and application of futures trading month codes is of paramount importance for traders and market participants. By correctly identifying the delivery months, traders can effectively plan their strategies, analyze trends, and minimize potential confusion when trading futures contracts.

Key Takeaways

- Futures trading month codes represent specific contract months in futures contracts.

- Understanding these codes is crucial for effective communication and execution of trading strategies.

- Common futures trading month codes follow a standardized system.

- Traders need to be aware of contract expiry and the rollover process.

- Proper interpretation of these codes ensures accurate trading decisions and risk management.

FAQ

-

What are futures trading month codes?

Futures trading month codes are abbreviated symbols used to represent specific contract months within futures contracts.

-

Why are futures trading month codes important?

These codes help traders identify and differentiate between delivery months of futures contracts, enabling effective planning and analysis of trading strategies.

-

Are futures trading month codes the same for all financial instruments?

No, different financial instruments may have variations in their respective futures trading month codes. It is important to consult the specific code chart for each instrument.

-

How should I approach the contract rollover process?

When nearing contract expiry, traders should close out positions in the expiring contract and simultaneously initiate new positions in the succeeding contract to ensure a smooth transition.

No comments:

Post a Comment