Table of Contents

- Introduction

- Market Challenges

- Adverse Weather Conditions

- Competitive Landscape

- Shift in Investor Sentiment

- Financial Performance

- Future Outlook

Introduction

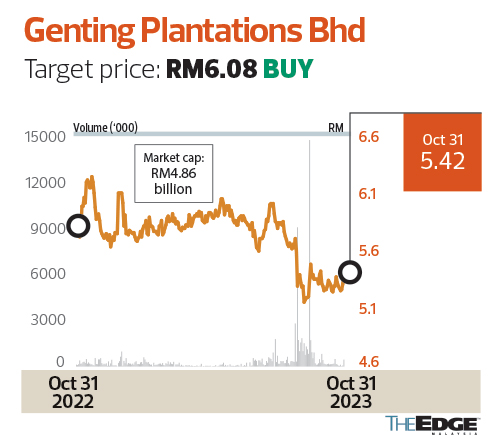

Provide an overview of Genting Plantation, its operations, and its significance in the agricultural industry. Briefly discuss the recent drop in share price.

Market Challenges

Discuss the various challenges faced by the global agricultural industry, including changes in trade policies, fluctuating commodity prices, and evolving consumer preferences. Explain how these challenges can impact Genting Plantation's share price.

Market Challenges: Why Genting Plantation Share Drops

Genting Plantation, a renowned player in the palm oil industry, has been facing a decline in its share prices due to various market challenges. This short article will shed light on some of the key reasons behind the drop in Genting Plantation's share value.

1. Fluctuating Palm Oil Prices:

One of the significant market challenges faced by Genting Plantation is the volatile nature of palm oil prices. Palm oil prices are subject to fluctuations due to factors such as changes in global demand, weather conditions affecting crop yield, and geopolitical issues. The uncertainty surrounding palm oil prices has adversely impacted the company's financial performance, leading to a decrease in investor confidence.

2. Intensifying Competition:

The palm oil industry is highly competitive, with numerous players vying for market share. Genting Plantation faces fierce competition from both domestic and international palm oil producers. This intensifying competition has put pressure on the company to enhance productivity and operational efficiency to maintain its market position. The perceived inability to effectively compete has led to a decrease in investor interest, resulting in a decline in share prices.

3. Environmental Concerns:

The palm oil industry has faced criticism regarding its environmental impact, primarily due to deforestation practices and habitat destruction. Genting Plantation has also faced scrutiny and legal challenges related to environmental concerns. As investors increasingly prioritize sustainable and socially responsible investments, these controversies have adversely affected the company's reputation and investor sentiment, leading to a drop in share prices.

4. Regulatory Changes:

Changes in government regulations and policies related to palm oil production and trade have impacted Genting Plantation's operations and financial performance. Regulatory changes can involve modifications in import/export tariffs, quotas, and certifications, among other factors. Such changes often introduce uncertainties and challenges for the company, leading to decreased investor confidence and a subsequent decline in share prices.

Conclusion:

Genting Plantation's share prices have faced a downturn primarily due to market challenges, including fluctuating palm oil prices, intensifying competition, environmental concerns, and regulatory changes. It is essential for the company to address these challenges effectively through strategic measures to regain investor confidence and drive sustainable growth in the future.

Adverse Weather Conditions

Examine the effects of adverse weather conditions, such as droughts or floods, on agricultural production. Discuss any recent incidents and their impact on Genting Plantation's operations and share price.

Genting Plantation is a prominent company in the agriculture sector, specializing in palm oil production. However, recently, its share price has experienced a significant drop. This can be attributed to adverse weather conditions that have adversely affected its operations.

Impact of Adverse Weather Conditions

Extreme weather phenomena such as heavy rains, floods, and droughts have had a severe impact on Genting Plantation's operations. These conditions disrupt the normal functioning of plantations, leading to reduced productivity and lower yields.

Excessive rainfall causes soil erosion and affects the drainage system, leading to waterlogging in the plantation areas. This waterlogging not only hampers the growth of palm oil trees but also makes it difficult for machinery and vehicles to operate effectively.

Conversely, prolonged droughts result in water scarcity, negatively impacting irrigation and the overall health of palm oil trees. The lack of adequate moisture leads to stunted growth, decreased oil production, and increased susceptibility to diseases and pests.

Financial Implications

Due to the adverse weather conditions, Genting Plantation has experienced a significant decline in palm oil production, subsequently affecting its revenue and profitability. Lower yields directly translate to reduced sales and lower income for the company.

Moreover, the company incurs additional costs in terms of repairing infrastructure, implementing mitigation measures, and investing in advanced technology to adapt to changing climatic conditions. These expenditures further strain the company's finances and negatively impact its stock value.

Mitigation Strategies

To combat the adverse weather conditions and stabilize its operations, Genting Plantation has implemented several mitigation strategies:

- Investing in advanced weather monitoring systems to predict and prepare for extreme weather events.

- Adopting sustainable farming practices that minimize environmental impact and enhance resilience to changing weather patterns.

- Diversifying their agricultural portfolio to reduce reliance on palm oil and explore alternative crops.

- Improving drainage systems and water management techniques to combat waterlogging and drought-related challenges.

- Collaborating with research institutions and experts to develop innovative solutions to tackle climate-related issues.

The drop in Genting Plantation's share price can be directly linked to adverse weather conditions that have disrupted its operations and reduced palm oil production. However, through implementing mitigation strategies, the company aims to mitigate the impact of such weather events and restore its profitability in the long run.

Competitive Landscape

Analyze the competitive landscape of the palm oil industry, identifying key players and their strategies. Discuss any market developments or new entrants that might have influenced Genting Plantation's share price.

Genting Plantations is a renowned Malaysian palm oil plantation company. However, in recent times, the company has witnessed a drop in its share value. Several factors have contributed to this decline in share price.

Competitive Landscape:

The palm oil industry operates in a highly competitive landscape with various key players globally. Genting Plantations faces tough competition from other palm oil producers, both within Malaysia and internationally. Major competitors include companies like Sime Darby Plantation, IOI Corporation, and Wilmar International.

Additionally, increasing concerns over sustainability and environmental issues in the palm oil industry have led to heightened competition. Consumers and investors are increasingly demanding sustainably sourced palm oil, forcing companies like Genting Plantations to adapt and meet these demands.

Reasons for Share Price Drop:

1. Fluctuations in Palm Oil Prices: One of the primary reasons for the drop in Genting Plantation shares is the volatility in palm oil prices. Palm oil prices are heavily influenced by global factors such as weather conditions, demand-supply dynamics, and government policies. Any unfavorable changes in these factors can negatively impact the company's profitability and, subsequently, its share value.

2. Regulatory Changes: Changes in regulations, both domestic and international, can have a significant impact on palm oil companies. Stringent regulations related to land use, deforestation, and sustainable practices can lead to increased compliance costs and operational challenges, affecting Genting Plantations' profitability and share prices.

3. Market Oversupply: Over the years, there has been an oversupply of palm oil in the global market, leading to downward pressure on prices. This oversupply scenario is primarily attributed to increased production from major palm oil-producing countries like Malaysia and Indonesia. Lower palm oil prices can directly impact the company's revenue and, subsequently, its share price.

4. Currency Exchange Rates: As a palm oil producer based in Malaysia, Genting Plantations is vulnerable to fluctuations in currency exchange rates. A stronger Malaysian Ringgit compared to other currencies can negatively impact the company's competitiveness in the global market, affecting its sales volume and share prices.

In conclusion, Genting Plantations' drop in share value can be attributed to various factors within the competitive landscape, including price fluctuations, regulatory changes, oversupply, and currency exchange rates. Adapting to these challenges and implementing strategies to maintain a competitive edge will be crucial for the company's future growth and stock performance.

Shift in Investor Sentiment

Explore factors that can affect investor sentiment, including changes in global economic conditions, political uncertainties, or scandals in the agricultural sector. Explain how a shift in investor sentiment can contribute to a drop in Genting Plantation's share price.

Genting Plantation, a leading agricultural company, has experienced a significant drop in its share price due to a shift in investor sentiment. This change in perception among investors has had a direct impact on the company's stock performance.

Reasons behind the Share Drop

Several factors have contributed to the decline in investor sentiment towards Genting Plantation:

- Weak financial performance: The company's recent financial reports have shown a decline in profits, primarily attributed to a decrease in palm oil prices and unfavorable weather conditions affecting crop yields.

- Market uncertainty: Global economic uncertainties, trade tensions, and geopolitical factors have added to the cautiousness of investors, leading to a decrease in demand for the company's shares.

- Sustainability concerns: Increasing focus on sustainable practices and environmental conservation has put pressure on palm oil companies. Investors are concerned about Genting Plantation's adherence to sustainable sourcing and potential negative impacts on the environment.

Impact on the Company

The decline in investor sentiment has resulted in a considerable drop in Genting Plantation's share price. This can lead to various consequences for the company:

- Reduced access to capital: Lower share prices make it difficult for the company to raise funds for expansion, research, and development initiatives.

- Increased cost of capital: With a decrease in investor confidence, the company may have to pay higher interest rates when seeking loans or issuing new bonds.

- Damaged reputation: A drop in share price can affect the company's reputation, making it harder to attract new investors or business partners.

Steps Taken by Genting Plantation

Genting Plantation is taking several measures to address the decline in investor sentiment:

- Improving financial performance: The company is focusing on cost optimization, increasing operational efficiency, and diversifying its revenue streams to mitigate the impact of volatile palm oil prices and unpredictable weather conditions.

- Sustainability commitment: Genting Plantation is enhancing its sustainable practices, ensuring responsible sourcing, and engaging in environmental conservation efforts to address investor concerns and strengthen its reputation as a sustainable palm oil producer.

- Investor communication: The company is actively communicating with its shareholders, providing transparent updates on its initiatives and addressing concerns to rebuild investor trust.

Genting Plantation's share drop is primarily a result of the shift in investor sentiment driven by weak financial performance, market uncertainties, and sustainability concerns. The company's efforts to improve financials, commit to sustainability, and enhance investor communication will be crucial in rebuilding confidence and stabilizing its share price in the long run.

Financial Performance

Evaluate Genting Plantation's recent financial performance, including revenue, profitability, and key financial ratios. Identify any weaknesses or challenges that could have influenced the drop in share price.

Genting Plantations, a renowned agricultural company, has experienced a recent decline in the value of its shares. This drop in share prices can be attributed to various financial factors and market dynamics affecting the company.

Possible Reasons for the Share Drop:

- Poor Financial Results: Genting Plantations might have reported lower than expected earnings or revenue figures in recent financial statements, leading investors to sell their shares.

- Industry-Specific Challenges: Factors such as fluctuating commodity prices, adverse weather conditions, or disease outbreaks affecting crop yield may have negatively impacted the company's profitability and consequently affected its share price.

- Global Economic Factors: A downturn in the global economy, trade wars, or geopolitical uncertainties can influence investor sentiment, leading to a drop in share prices across various sectors, including agriculture.

- Company-specific Concerns: News regarding corporate governance issues, management changes, or any negative publicity may undermine investor confidence in the company's future prospects, resulting in a decline in share value.

- Competitive Pressures: Increased competition from other agricultural players, new market entrants, or the emergence of substitute products could have affected Genting Plantations' market position, impacting its share price.

While the specific reasons behind Genting Plantations' share drop may require a detailed analysis of the company's financial reports, market trends, and industry conditions, these potential factors can help explain the decline. Investors should closely monitor future financial performance indicators and company updates to make informed investment decisions.

Future Outlook

Provide an outlook for Genting Plantation's future prospects, considering factors such as potential growth opportunities, expansion plans, and market forecasts. Discuss any potential catalysts that could reverse the share price decline.

Genting Plantation, one of the leading plantation companies in the world, has experienced a significant drop in its share value recently. There are several factors contributing to this decline, and it is crucial to analyze them to understand the future outlook for the company.

1. Declining Global Palm Oil Demand

Genting Plantation heavily relies on the production and sale of palm oil. Unfortunately, the global demand for palm oil has been declining due to increasing consumer concerns over environmental sustainability and deforestation. This drop in demand has directly affected the company's revenue and subsequently led to a decrease in its share value.

2. Environmental Regulations

Environmental regulations have become more stringent worldwide, particularly in major palm oil importing countries. These regulations aim to curb deforestation and promote sustainable agricultural practices. Genting Plantation, like other palm oil companies, has had to invest in costly sustainability measures to comply with these regulations. These additional expenses have negatively impacted the company's profitability and ultimately contributed to the decline in share prices.

3. Impact of COVID-19

The ongoing COVID-19 pandemic has disrupted global supply chains, including the palm oil industry. With restricted mobility and reduced consumer spending, demand for various commodities, including palm oil, has suffered. Genting Plantation has faced logistical challenges in exporting its products, resulting in lower sales and revenue. This pandemic-induced market uncertainty has played a role in the decline of the company's share value.

4. Market Volatility

The stock market is known for its inherent volatility, influenced by various factors such as geopolitical events, economic conditions, and investor sentiment. The overall market volatility has also affected Genting Plantation's share price. Uncertainties surrounding international trade tensions, political instability, and other external factors have contributed to investor hesitations and led to a drop in share value.

Genting Plantation's recent drop in share value can be attributed to declining global palm oil demand, environmental regulations, the impact of COVID-19, and market volatility. While these factors present significant challenges, it is essential to note that the company can still work towards mitigating these issues. Implementing sustainable practices, diversifying revenue streams, and adapting to changing market conditions can help Genting Plantation regain its position in the market and improve its future outlook.

Key Takeaways

- Global agricultural challenges can impact Genting Plantation's share price.

- Adverse weather conditions have the potential to disrupt production and affect share prices.

- Understanding the competitive landscape helps to assess Genting Plantation's market position.

- Investor sentiment plays a crucial role in shaping share prices.

- Financial performance indicators offer insights into Genting Plantation's share price movements.

- An assessment of future prospects provides an outlook for share price recovery.

Frequently Asked Questions

- Q: Has Genting Plantation faced any significant production challenges in recent years?

- A: Yes, adverse weather conditions and disease outbreaks have occasionally affected production levels.

- Q: Are there any plans for diversification in Genting Plantation's operations?

- A: Genting Plantation has shown interest in exploring opportunities beyond palm oil, including sustainable farming initiatives.

- Q: What impact have changes in global trade policies had on Genting Plantation's share price?

- A: Trade policy fluctuations can affect demand and pricing, indirectly impacting the company's share price.

- Q: How does Genting Plantation prioritize environmental sustainability?

- A: Genting Plantation has implemented various sustainable practices, including zero-burning policies and wildlife conservation efforts.

No comments:

Post a Comment