Table of Contents

- Introduction

- How Money Creation Works

- Implications for the Economy

- Regulatory Framework

- Controversies Surrounding Money Creation

- Benefits and Risks of Commercial Banks' Money Creation

- Conclusion

Introduction

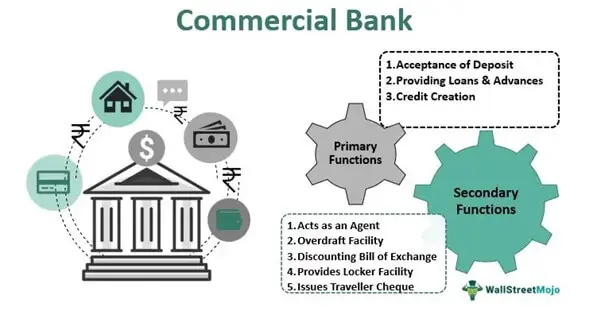

In this article, we delve into the fascinating world of commercial banks and their pivotal role in the creation of money within the economy. By exploring the mechanisms employed by these banks, we gain valuable insights into how money is brought into circulation and the consequences this process has on various sectors.

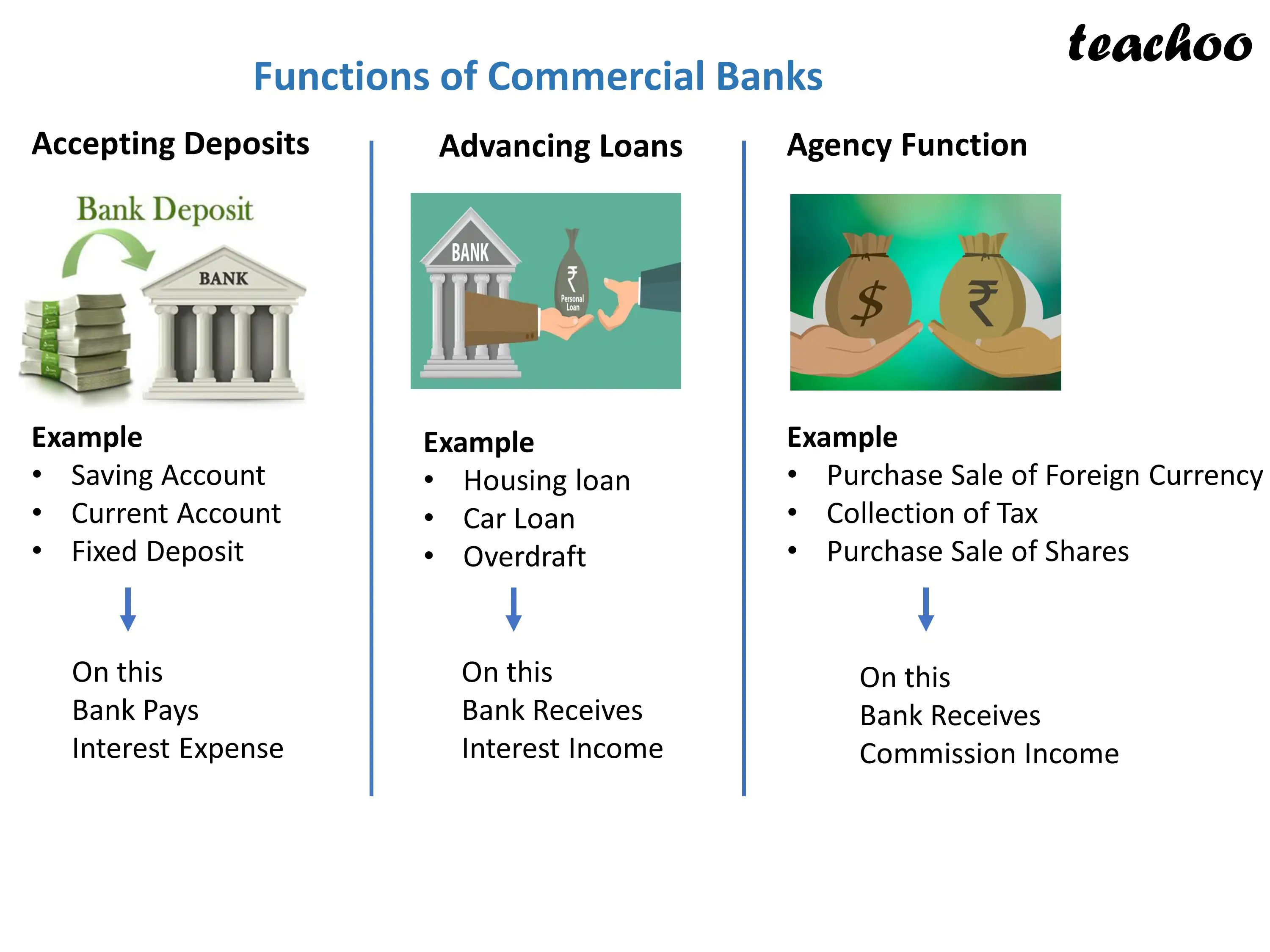

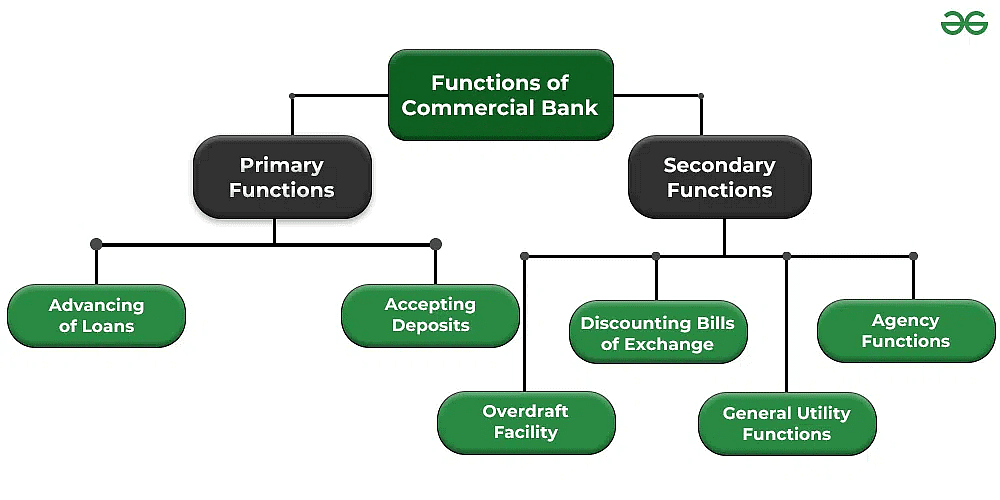

How Money Creation Works

Here, we dissect the step-by-step process of money creation by commercial banks. From deposit multiplication to fractional reserve banking, we shed light on the methods utilized to generate funds that fuel economic growth and expansion.

Commercial banks play a crucial role in the money creation process. Here's how it works:

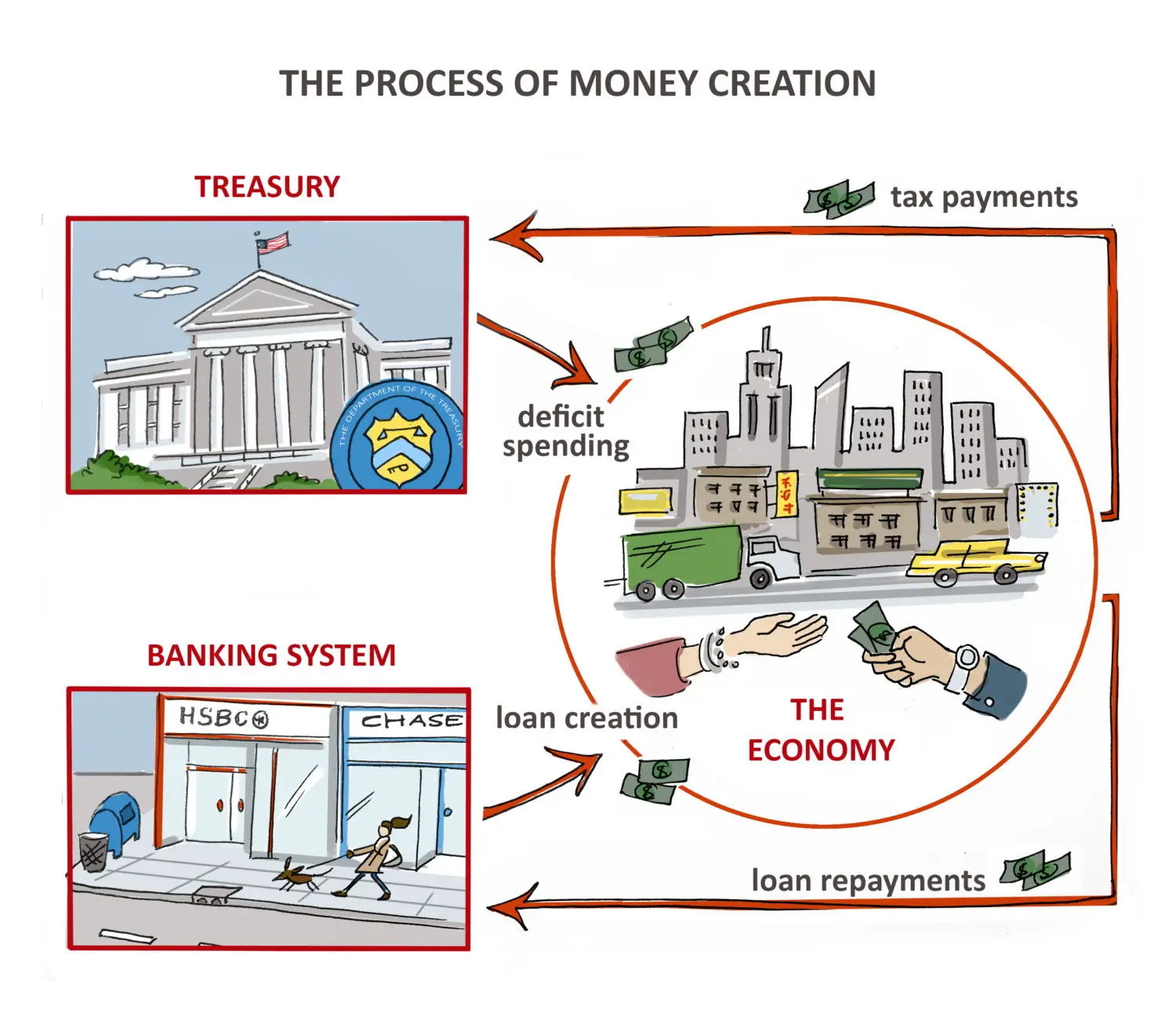

1. Deposits

When individuals or businesses deposit money in a commercial bank, it becomes a liability for the bank. The deposited money is held as reserves.

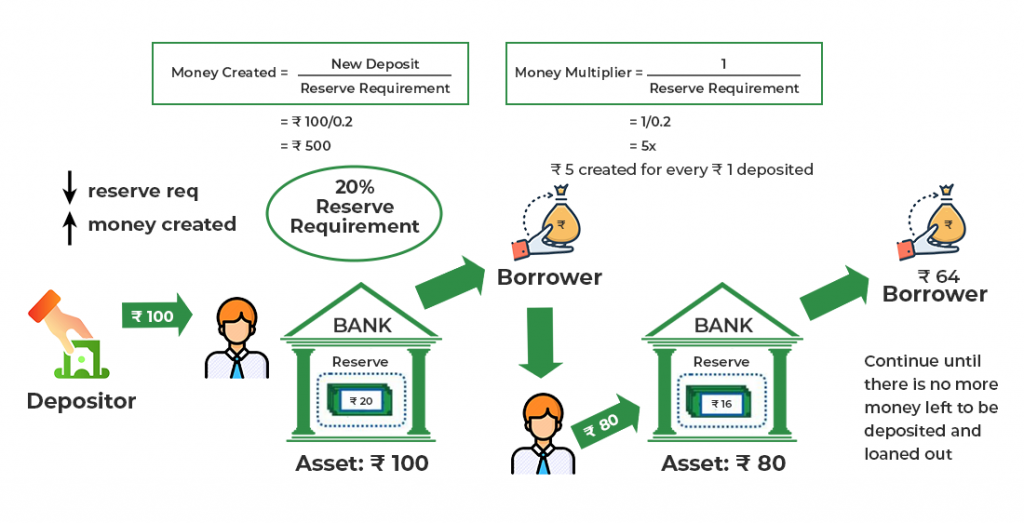

2. Reserves

The reserves serve as a base for lending activities. Banks are required to keep a certain percentage of their deposits as reserves, known as the reserve ratio.

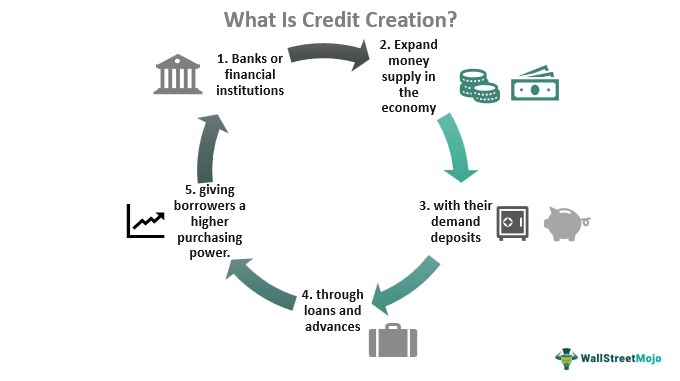

3. Loans and Credit Creation

Commercial banks utilize a fraction of the deposits as reserves to grant loans and create credit. These loans are extended to borrowers for various purposes, such as starting a business, buying a house, or funding personal needs.

4. Money Creation

When a loan is granted, the borrower receives the loan amount in their account. This creates new money in the economy. The money created is equal to the loan amount.

5. Multiple Deposits and Loans

The newly created money can be deposited in another bank, leading to further lending and credit creation. This cycle continues, creating a multiplier effect on the initial deposit.

6. Repayments and Destruction of Money

As borrowers repay their loans, the money is taken out of circulation, effectively reducing the overall money supply in the economy.

In conclusion, commercial banks have the power to create money through the process of lending and credit creation. This plays a crucial role in facilitating economic growth and supporting financial activities.

Implications for the Economy

This section outlines the broader impact of money creation on the economy. By analyzing the relationships between commercial banks, borrowers, and consumers, we evaluate the potential benefits and challenges that arise from the expansion of the money supply.

The money creation function of commercial banks plays a crucial role in the economy. When commercial banks create money, it has both positive and negative implications for the economy.

Positive Implications:

- Economic Growth: Money creation by commercial banks helps stimulate economic growth by increasing the money supply available for businesses and individuals to spend on goods and services. This can lead to increased investment, consumption, and overall economic activity.

- Increased Liquidity: Money creation by banks improves liquidity in the economy, making it easier for individuals and businesses to access funds. This liquidity allows for smoother transactions and facilitates economic transactions.

- Expansion of Credit: Money creation enables banks to extend credit to borrowers, supporting entrepreneurship, business expansion, and investment opportunities. This promotes economic development and job creation.

Negative Implications:

- Inflationary Pressure: Excessive money creation by commercial banks can lead to inflation as the increased money supply exceeds the available goods and services. This erodes the purchasing power of the currency, making it more expensive to buy goods and services.

- Asset Price Inflation: When banks create money, it can lead to inflation in asset prices, such as real estate or stocks. This can result in asset bubbles and increase wealth inequality in the economy.

- Risk of Financial Instability: Money creation function carries the risk of creating financial instability in the economy. If banks make risky loans or engage in speculative activities, it can lead to economic downturns, banking crises, and the need for government intervention.

In conclusion, while the money creation function of commercial banks brings about economic growth, increased liquidity, and credit expansion, it also carries the risks of inflation, asset price inflation, and financial instability. Therefore, it is important for banks and regulatory bodies to monitor and regulate the money creation process to ensure its positive impact on the economy.

Regulatory Framework

Understanding the regulations governing commercial banks' money creation is crucial to ensuring a stable financial system. Here, we discuss the key regulatory frameworks in place and their role in safeguarding against risks associated with excessive money creation.

The money creation function of commercial banks is an important aspect of the economy. However, to ensure stability and control, there exists a regulatory framework that governs this process. These regulations are put in place to maintain the confidence of the public in the banking system and prevent any misuse of power by the commercial banks.

One crucial element of this regulatory framework is reserve requirements. Commercial banks are required to hold a certain percentage of their deposits as reserves, which can be either in the form of cash or deposits with the central bank. This ensures that banks have enough liquidity to meet the demands of their depositors and reduces the risk of a bank run. The reserve requirements also act as a control mechanism to limit excessive money creation by banks.

Additionally, the central bank plays a pivotal role in regulating money creation. Through its monetary policy, the central bank can influence the lending capacity of commercial banks by adjusting key interest rates. By raising interest rates, the central bank can discourage borrowing and reduce the money supply, while lowering interest rates can encourage lending and stimulate economic growth. This mechanism allows the central bank to regulate the overall money creation process.

Furthermore, regulatory frameworks often include guidelines and regulations regarding loan classifications and risk management practices. Banks are required to assess the creditworthiness of borrowers and make responsible lending decisions to mitigate the risk of loan defaults. This ensures the stability of the banking system and prevents excessive money creation based on poor lending practices.

In conclusion, the regulatory framework in the money creation function of commercial banks is essential for maintaining stability, controlling the money supply, and safeguarding the interests of the public. It consists of reserve requirements, central bank policies, and risk management guidelines that collectively contribute to a well-regulated banking system.

Controversies Surrounding Money Creation

Money creation by commercial banks has long been a subject of debate and scrutiny. We address common controversies surrounding this practice, including concerns about inflation, debt accumulation, and potential instability in the financial system.

The money creation function of commercial banks has been a subject of numerous controversies and debates among economists and policymakers. Here are some key points regarding the controversies surrounding money creation:

1. Fractional Reserve Banking:

One major controversy revolves around the fractional reserve banking system. In this system, banks are only required to keep a fraction of deposits as reserves while lending out the remaining funds. Critics argue that this system leads to excessive credit creation, potentially fueling asset bubbles and financial instability.

2. Creation of Money through Debt:

Another point of controversy lies in the fact that commercial banks create money primarily through lending and creating debt. Critics argue that this can lead to a debt-driven economy, where excessive borrowing and debt accumulation can cause financial vulnerability and economic instability.

3. Central Bank Control:

The role of central banks in controlling money creation by commercial banks is another area of controversy. Critics argue that the central banks' ability to influence money creation can lead to improper distribution of wealth, favoring certain sectors or groups while neglecting others.

4. Lack of Transparency:

Controversy arises due to the lack of transparency in the money creation process by commercial banks. Critics argue that this lack of transparency makes it difficult to accurately assess the potential risks associated with money creation, leading to inadequate regulatory measures and potential systemic risks.

5. Money Creation and Inflation:

The link between money creation and inflation is a subject of controversy. While some argue that increased money creation can lead to inflationary pressures, others believe that inflation is primarily influenced by factors such as aggregate demand, supply-side shocks, and expectations.

These controversies surrounding money creation in the money creation function of commercial banks continue to shape the ongoing debates on monetary policy, financial regulation, and economic stability.

Benefits and Risks of Commercial Banks' Money Creation

In this section, we provide an unbiased assessment of the benefits and risks associated with commercial banks' money creation. We analyze the potential positive effects on investment and economic growth, as well as the inherent risks and vulnerabilities that emerge as a consequence.

Commercial banks play a crucial role in the economy by creating money through the process of lending. This function of money creation has several benefits and risks associated with it.

Benefits:

- Economic growth: Money creation by commercial banks facilitates lending to individuals and businesses, which stimulates economic growth. It provides funds for investments, entrepreneurship, and consumption.

- Liquidity: By creating money, commercial banks increase the overall liquidity in the economy. This ensures that individuals and businesses have access to funds when needed, promoting financial stability.

- Financial intermediation: Money creation allows commercial banks to act as intermediaries between savers and borrowers. They channel funds from savers who have excess money to borrowers who need capital, improving capital allocation efficiency.

- Interest income: Money creation generates interest income for commercial banks through the interest charged on loans. This is a significant revenue stream for banks, contributing to their profitability.

Risks:

- Inflation: The creation of excessive money by commercial banks can lead to inflationary pressures in the economy. When there is too much money chasing the same amount of goods and services, it can drive up prices, eroding the purchasing power of individuals.

- Financial instability: Money creation can contribute to financial instability if not properly managed. Banks may engage in risky lending practices, creating an unsustainable level of debt that can result in financial crises.

- Credit risk: Commercial banks face the risk of default when borrowers are unable to repay their loans. If a large number of loans turn bad, it can lead to significant losses for banks and impact their solvency.

- Bank runs: If depositors lose confidence in the banking system, they may rush to withdraw their funds, leading to a bank run. This can cause liquidity shortages for banks and result in a systemic crisis.

Overall, commercial banks' money creation function has both benefits and risks. When managed effectively and with appropriate regulations, it can promote economic growth and financial stability. However, if misused or unchecked, it can have adverse consequences for the economy and the banking system.

Conclusion

Concluding our exploration of the money creation function of commercial banks, we recap the key findings and implications. By recognizing the crucial role played by commercial banks, we gain a deeper understanding of the dynamics of our financial system and its impact on our daily lives.

Key Takeaways

- Commercial banks play a central role in the creation of money within the economy.

- The money creation process involves deposit multiplication and fractional reserve banking.

- Money creation by banks has implications for economic growth, inflation, and financial stability.

- Regulatory frameworks are in place to oversee and manage money creation activities.

- Controversies surrounding money creation include concerns about inflation and debt accumulation.

- Commercial banks' money creation offers benefits for investment and growth but comes with inherent risks.

- Understanding the money creation function is essential for comprehending the workings of the financial system.

Frequently Asked Questions (FAQ)

1. Can commercial banks create money out of thin air?

While commercial banks have the power to create money through the process of lending, this power is regulated and subject to reserve requirements.

2. What is fractional reserve banking?

Fractional reserve banking is a system in which commercial banks keep a fraction of their customers' deposits as reserves while using the remainder to extend loans.

3. How does money creation impact inflation?

The expansion of the money supply resulting from money creation can lead to inflation if the increase exceeds the growth of goods and services in the economy.

No comments:

Post a Comment