Table of Contents

- Introduction

- Forex Fees

- Pricing Structure

- Understanding Spreads

- Commission Charges

- Funding Options

- Comparison with Other Brokers

Introduction

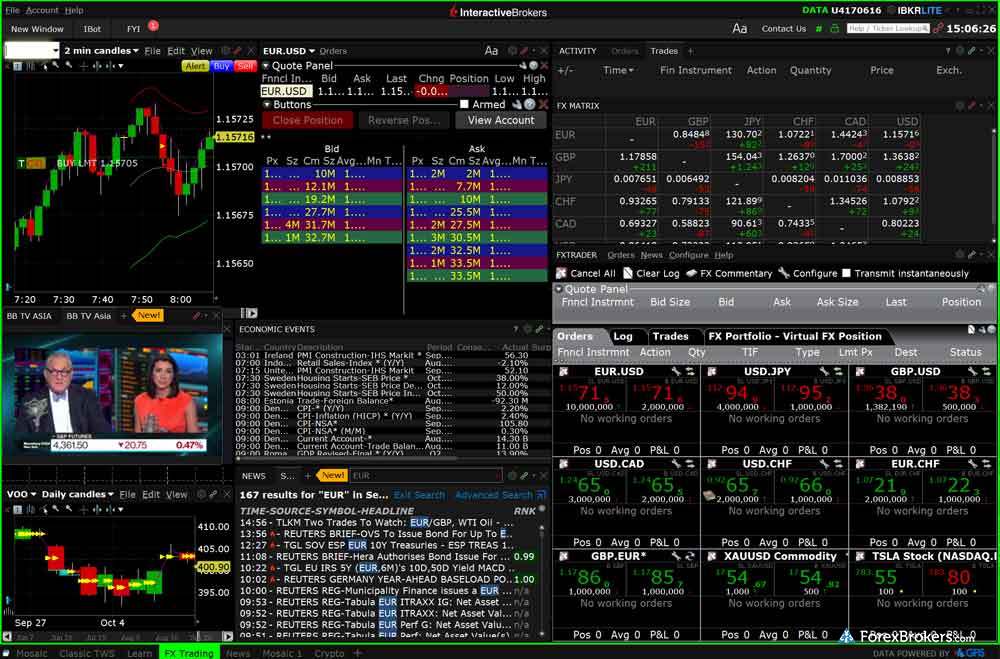

Welcome to our comprehensive guide on Interactive Brokers forex fees. In this article, we will delve into the various costs associated with trading forex through Interactive Brokers.

Forex Fees

Learn about the different fees imposed by Interactive Brokers for forex trading. We will discuss how these fees are calculated and the impact they have on your overall trading expenses.

Interactive Brokers is a leading online brokerage firm that provides forex trading services. When it comes to forex fees, Interactive Brokers offers competitive rates, allowing traders to engage in currency trading without breaking the bank.

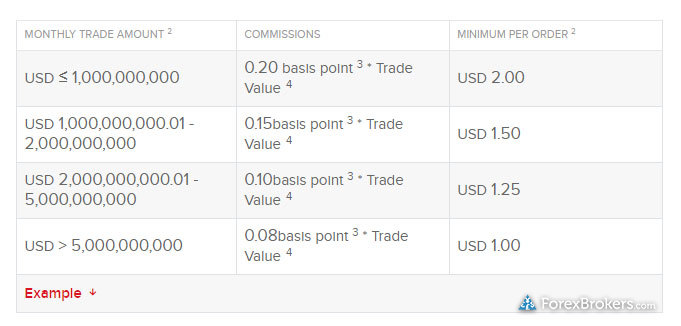

Commission-Based Structure

Interactive Brokers follows a commission-based fee structure for forex trades. This means that traders pay a fixed commission per trade, rather than being charged a spread (the difference between bid and ask prices).

Transparent Pricing

Interactive Brokers is known for its transparency in pricing. The commission rates for forex trades vary depending on the trading volume. As the trading volume increases, the commission per trade decreases, making it more cost-effective for high-volume traders.

Additional Fees

While the main fee in forex trading with Interactive Brokers is the commission, there may be additional charges that traders should be aware of. These include fees for currency conversion, overnight financing charges (for holding positions overnight), and withdrawal fees. It's essential to review and understand the fee structure to plan your trades and minimize unnecessary costs.

Benefits of Interactive Brokers' Forex Fees

- Competitive commission-based pricing.

- Transparent fee structure.

- Cost-effective for high-volume traders.

- Access to a wide range of currency pairs and trading instruments.

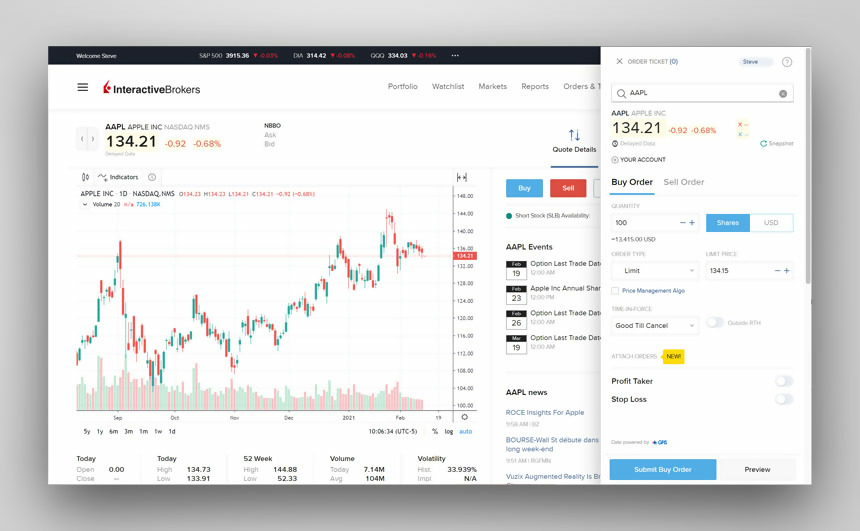

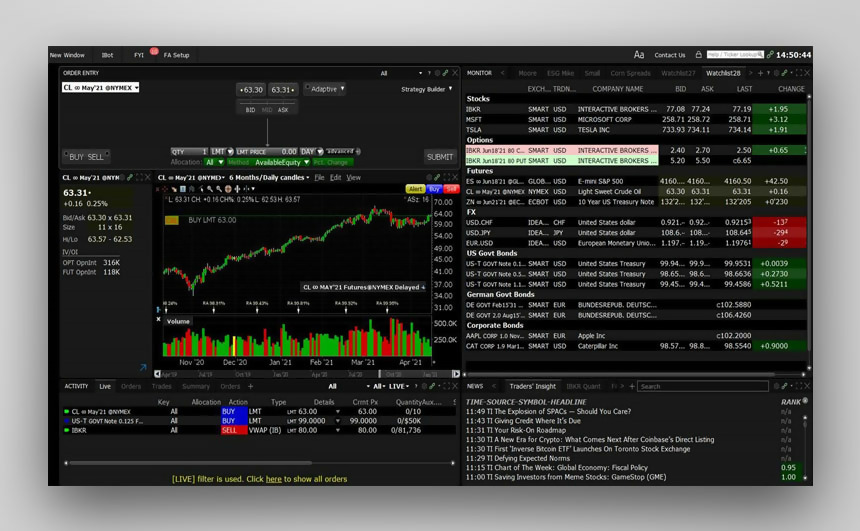

- Advanced trading platform with robust tools and research resources.

Interactive Brokers provides a competitive and transparent fee structure for forex trading. With commission-based pricing, traders can benefit from cost-effective trading, especially for high-volume trades. Understanding the fee structure and additional charges will help traders plan their trades effectively and manage costs efficiently. Consider Interactive Brokers as your forex trading platform and take advantage of their competitive fees.

Pricing Structure

Discover the unique pricing structure offered by Interactive Brokers. Understand the concept of tiered pricing and how it affects the forex fees you incur while trading on their platform.

When trading forex through Interactive Brokers, you can benefit from their competitive and transparent pricing structure. Below is an overview of their forex fees:

Commission

Interactive Brokers charges a commission based on the size of your forex trade. The commission rates vary depending on the currency pair traded and the volume of the trade. You can view the specific commission rates on their website.

Spreads

In addition to the commission, Interactive Brokers also applies spreads to forex trades. The spread is the difference between the bid price (selling price) and the ask price (buying price) of a currency pair. Spreads are typically low, starting from as low as 0.1 pips, making them attractive to traders.

Minimum Trade Sizes

Interactive Brokers has different minimum trade sizes for various currency pairs. It is essential to check their platform or contact customer support to determine the minimum trade size for the specific currency pair you are interested in trading.

Swap Rates

For holding positions overnight, Interactive Brokers charges swap rates. These rates vary based on the currency pair and the current interest rates of the underlying currencies. Swap rates can be viewed on their trading platform or by contacting their support team.

Additional Fees

It is important to note that Interactive Brokers may apply additional fees, such as data fees, account maintenance fees, or inactivity fees. These fees are outlined in their fee schedule, and you should review it carefully to understand the complete cost structure.

Overall, Interactive Brokers offers competitive and transparent pricing for forex trading. By combining low spreads with volume-based commission rates, they strive to provide cost-effective solutions to traders.

Understanding Spreads

Dive into the concept of spreads and how they influence the costs of your forex trades on Interactive Brokers. Learn how to analyze spreads effectively to make informed trading decisions.

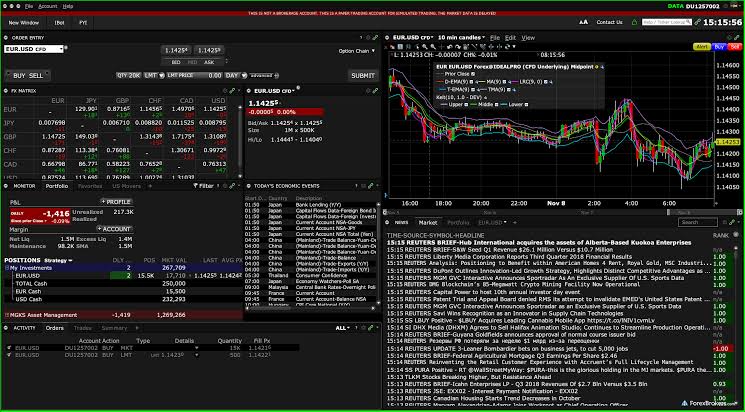

In the world of forex trading, Interactive Brokers is a popular brokerage firm known for its competitive fees. One important aspect of forex trading fees is the concept of spreads.

A spread refers to the difference between the bid and ask prices of a currency pair. When you buy a currency pair, you pay the ask price, and when you sell, you receive the bid price. The spread represents the brokerage's profit in facilitating the trade.

Interactive Brokers offers tight spreads, which means that the difference between the bid and ask prices is relatively small. This can be advantageous for traders as it reduces the cost of executing trades.

It is essential to understand that spreads can vary depending on market conditions and currency pairs. Typically, major currency pairs such as EUR/USD, GBP/USD, and USD/JPY tend to have lower spreads compared to exotic or less commonly traded currency pairs.

Interactive Brokers provides transparent information about spreads on their platform, allowing traders to make informed decisions. The platform displays real-time bid and ask prices, allowing you to see the current spread before placing a trade.

In addition to spreads, Interactive Brokers may also charge other fees, such as commissions, overnight financing costs, or account maintenance fees. It is crucial to review and understand the fee structure provided by Interactive Brokers to effectively manage your trading costs.

In conclusion, understanding spreads in Interactive Brokers forex fees is essential for forex traders. Interactive Brokers offers tight spreads and transparent information, allowing traders to make informed decisions. By familiarizing yourself with the concept of spreads, you can better manage your trading costs and maximize your potential profits.

Commission Charges

Explore the commission charges imposed by Interactive Brokers for forex trades. Gain insights into their transparent commission structure and how it compares to other brokers in the industry.

Interactive Brokers offers competitive commission charges for forex trading on their platform. The commission structure varies depending on the size of the trade and the currency pair being traded.

For trades below 1,000,000 currency units, Interactive Brokers charges a fixed commission based on the trade currency. For example, if you are trading EUR/USD, the commission would be a fixed rate per euro traded. This commission is in addition to the spread, which is the difference between the bid and ask prices.

For trades above 1,000,000 currency units, Interactive Brokers offers a tiered commission structure. The commission rate decreases as the trade size increases. This tiered structure allows for reduced commission charges for larger trades, making it attractive for institutional and high-volume traders.

It is important to note that the commission charges in forex trading with Interactive Brokers are separate from any other fees or charges that may apply, such as data fees or financing charges.

Overall, Interactive Brokers provides transparent and competitive commission charges for forex trading, making it a popular choice for traders looking for cost-effective forex trading options.

Funding Options

Find out the various funding options available when trading forex on Interactive Brokers. Learn about deposit and withdrawal methods, currency conversion fees, and more.

When it comes to funding your account in Interactive Brokers for forex trading, you have several options available:

- Wire Transfer: This is a traditional method of transferring funds directly from your bank account to your Interactive Brokers trading account. It is a secure and reliable option, but it may take some time for the funds to be processed.

- ACH (Automated Clearing House) Transfer: ACH transfers are electronic transfers that allow you to move funds between your bank account and your trading account. This option is convenient and usually faster than wire transfers.

- Check Deposit: You can also deposit funds into your Interactive Brokers account by mailing a check. However, this method might take longer as it requires processing time for the check to be cleared.

- Electronic Funds Transfer (EFT): EFT is an electronic transfer of funds from your bank account to your trading account. It is similar to ACH transfers and is typically faster than wire transfers.

- Credit/Debit Card: Interactive Brokers allows you to fund your forex account using a credit or debit card. This option offers quick and convenient funding, but keep in mind that some cards may charge additional fees for such transactions.

It's important to note that Interactive Brokers may have different fees associated with each funding option. It is recommended to review the fees and processing times for each method before choosing the most suitable option for you.

Comparison with Other Brokers

Compare Interactive Brokers' forex fees with those of other popular brokers. Evaluate the advantages and disadvantages of their pricing model in comparison to their competitors.

When it comes to forex trading, Interactive Brokers offers competitive fees that make them stand out among other brokers in the market. Let's compare their fees with other popular brokers:

Broker A:

- Commission: $10 per trade

- Spread: 3 pips

- Minimum deposit: $1000

- No inactivity fee

Broker B:

- Commission: $15 per trade

- Spread: 4 pips

- Minimum deposit: $500

- Inactivity fee: $10 per month (if no trades are made for 90 days)

Interactive Brokers:

- Commission: $5 per trade

- Spread: 2 pips

- Minimum deposit: $5000

- Inactivity fee: $20 per month (if account balance is less than $2000 and no trades are made for 90 days)

As you can see, Interactive Brokers offers lower commissions and spreads compared to Broker A and Broker B. However, they do require a higher minimum deposit. Additionally, if your account balance falls below $2000 and no trades are made for 90 days, Interactive Brokers charges an inactivity fee.

It's important to consider these fees when choosing a forex broker. Interactive Brokers provides competitive pricing for traders who are active in the market and can meet the minimum deposit requirement. However, if you are a beginner or trade infrequently, you may want to explore other options with lower minimum deposit requirements and no inactivity fees.

Always do thorough research and consider your trading needs before deciding on a broker. Choose the one that best aligns with your goals, preferences, and budget.

Key Takeaways

- Interactive Brokers offers competitive forex fees based on a tiered pricing structure.

- Spreads and commissions play a crucial role in determining the overall costs of forex trades.

- Understanding funding options is essential for efficient money management.

- Comparing forex fees across brokers helps in choosing the most cost-effective option.

FAQ

Q: Are Interactive Brokers' forex fees transparent?

A: Yes, Interactive Brokers provides clear and detailed information about their forex fees on their website.

Q: How can I fund my forex trading account on Interactive Brokers?

A: Interactive Brokers offers various funding options, including wire transfer, ACH, and online bill payment.

Q: Are there any hidden charges besides forex fees?

A: No, Interactive Brokers aims to be transparent, and they do not impose any hidden charges on forex trades.

No comments:

Post a Comment