Table of Contents

- Introduction

- Calls

- Puts

- Difference Between Calls and Puts

- Options

- Key Takeaways

- Frequently Asked Questions (FAQ)

Introduction

Welcome to our beginner's guide on understanding calls and puts in the stock market. This article aims to simplify the complex world of options trading, specifically focusing on calls and puts.

Calls

A call option gives the holder the right, but not the obligation, to buy an underlying asset at a specified price (known as the strike price) within a specific period of time.

Calls and puts are basic options trading concepts that every beginner should understand. Here's a simple explanation:

Calls

A call option gives the buyer the right, but not the obligation, to buy a specific stock at a predetermined price within a certain timeframe. This predetermined price is known as the "strike price". If the stock price rises above the strike price before the option expires, the buyer can exercise the option and buy the stock at the lower strike price, making a profit. However, if the stock price remains below the strike price or if the option expires before the stock price rises, the buyer can choose not to exercise the option and simply let it expire worthless.

Puts

On the other hand, a put option gives the buyer the right, but not the obligation, to sell a specific stock at a predetermined price within a certain timeframe. Again, this predetermined price is the strike price. If the stock price drops below the strike price before the option expires, the buyer can exercise the option and sell the stock at the higher strike price, making a profit. However, if the stock price remains above the strike price or if the option expires before the stock price drops, the buyer can choose not to exercise the option and let it expire worthless.

In simple terms, calls are for buying stocks at a specific price, and puts are for selling stocks at a specific price. These options allow investors to profit from changes in stock prices without owning the actual stock. However, it's important to note that options trading involves risks, and it's recommended to consult with a financial advisor or do thorough research before engaging in such trades.

Puts

A put option, on the other hand, gives the holder the right, but not the obligation, to sell an underlying asset at a specified price (strike price) within a specific period of time.

Are you new to the stock market? Feeling confused about puts and calls? Don't worry, we've got you covered!

What are Puts?

A put is a type of financial contract that gives the owner the right, but not the obligation, to sell a specific stock at a predetermined price (known as the strike price) within a certain timeframe. Puts are typically used as insurance against a potential drop in stock prices. If the stock's price falls below the strike price, the put holder can sell the stock at the higher strike price and minimize losses.

What are Calls?

On the other hand, a call is a financial contract that gives the owner the right, but not the obligation, to buy a specific stock at a predetermined price within a certain timeframe. Calls are usually used by investors who expect the price of a stock to rise. If the stock's price exceeds the strike price, the call holder can buy the stock at a lower strike price and profit from the price difference.

How Do Puts and Calls Work?

Let's understand the concept with a simple example:

Suppose you are interested in buying shares of XYZ Company, currently trading at $50 per share. However, you are concerned that the price might drop in the future. To protect yourself, you decide to buy a put option with a strike price of $45 and an expiration date of one month.

If, after one month, the stock price drops to $40, you can exercise your put option and sell the stock for $45 per share, even though its market value is only $40. This allows you to limit your losses.

On the other hand, if the stock price rises above $45, you can let the put option expire worthless, as it no longer makes financial sense to sell at a lower price.

Calls work in a similar manner, but in the opposite direction. If you buy a call option and the stock price exceeds the strike price, you can exercise the option and buy the stock at a lower price, making a profit.

Remember, options trading involves risks, and it is essential to do thorough research and understand the market before engaging in any transactions.

Hopefully, this brief explanation has helped you understand the basic concept of puts and calls. If you have any more questions, feel free to explore further or consult with a financial advisor.

Difference Between Calls and Puts

In this section, we'll explore the key differences between calls and puts, including their risk profiles and potential outcomes.

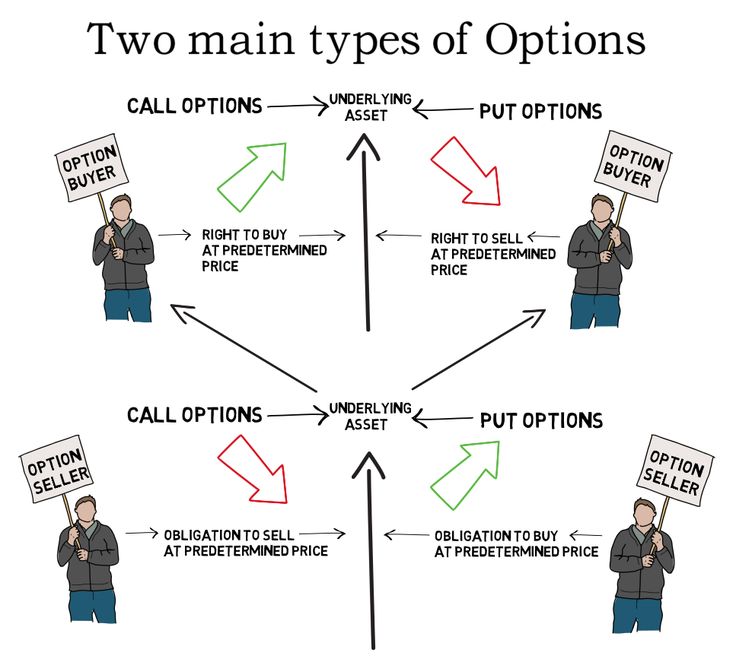

Understanding Calls

A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price within a specified period of time. In simple terms, a call option allows you to "call" or buy an asset at a predetermined price.

For example, let's say you have a call option on 100 shares of XYZ stock with a strike price of $50. This means that you have the option to buy those 100 shares of XYZ stock for $50 per share within a specified time frame.

Understanding Puts

A put option, on the other hand, gives the buyer the right, but not the obligation, to sell an underlying asset at a specified price within a specified period of time. In simple terms, a put option allows you to "put" or sell an asset at a predetermined price.

Continuing with the example above, if you have a put option on 100 shares of XYZ stock with a strike price of $50, this means that you have the option to sell those 100 shares of XYZ stock for $50 per share within the specified time frame.

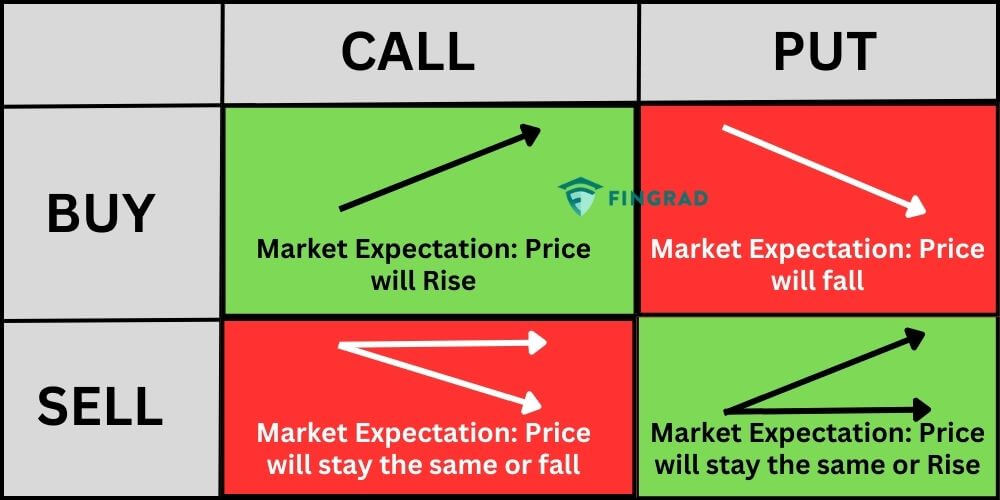

The Main Difference

The main difference between calls and puts is the direction of the underlying transaction. With calls, you have the right to buy the underlying asset, while with puts, you have the right to sell the underlying asset.

Profit Potential

The profit potential for both calls and puts depends on the price movement of the underlying asset. For call options, the buyer profits when the price of the underlying asset rises above the strike price. Conversely, for put options, the buyer profits when the price of the underlying asset falls below the strike price.

Risk and Loss Limitations

When buying calls or puts, the maximum risk for the buyer is limited to the premium paid for the option. This means that if the price of the underlying asset doesn't move in the desired direction, the buyer's loss is limited to the amount paid for the option.

In summary, calls and puts provide different rights to the buyers. Calls give the right to buy, while puts give the right to sell the underlying asset. The potential profit or loss depends on the price movement of the underlying asset, and the buyer's risk is limited to the premium paid for the option.

Options

Options are financial instruments that provide traders with the opportunity to hedge against risk, speculate on price movements, or generate income. In this section, we'll delve deeper into the world of options.

If you're new to investing and want to learn about options in calls and puts, you've come to the right place. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an asset (like stocks, bonds, or commodities) at a specific price within a predetermined period of time.

Calls:

A call option gives the holder the right to buy the underlying asset at a specified price, known as the strike price, on or before the expiration date. Let's say you purchase a call option for a particular stock with a strike price of $50 and an expiration date of one month from now. If the stock price rises above $50 during that time, you can exercise the option and buy the stock at the predetermined price, potentially making a profit. However, if the stock price remains below $50, you have the choice not to exercise the option and can let it expire worthless.

Puts:

A put option, on the other hand, grants the holder the right to sell the underlying asset at a specified price on or before the expiration date. Continuing with the same example, let's say you purchase a put option for the stock mentioned earlier with a strike price of $50 and an expiration date of one month. If the stock price falls below $50 within that timeframe, you can exercise the put option and sell the stock at the predetermined price, potentially profiting from the decline. If the stock price remains above $50, you have the choice not to exercise the option and can let it expire worthless.

Risks and Benefits:

Options trading involves risks and requires a thorough understanding of the market. One benefit of options is the potential for significant profits with relatively small investments. However, it's crucial to remember that options can expire worthless, resulting in a loss of the premium paid. Additionally, options trading can be complex, and it's important to seek professional advice or thoroughly educate yourself before getting involved.

Conclusion:

In summary, options in calls and puts offer individuals the opportunity to profit from the price movements of underlying assets without directly owning them. Calls provide the right to buy, while puts provide the right to sell. By understanding these concepts and carefully analyzing market conditions, investors can use options to their advantage in achieving their financial goals.

Key Takeaways

1. Calls give the right to buy, while puts give the right to sell.

2. The strike price is the agreed-upon price for the underlying asset.

3. Options allow investors to hedge against potential losses.

4. Options trading involves both risk and reward.

Frequently Asked Questions (FAQ)

Q: Are calls riskier than puts?

A: Both calls and puts carry their own risks. The level of risk depends on various factors, including market conditions and the individual's investment strategy.

Q: How long do options contracts last?

A: Options contracts have specific expiration dates. Typically, they can range from a few days to several years.

Q: Can I exercise my option before expiration?

A: In most cases, options can be exercised at any time before the expiration date.

No comments:

Post a Comment