Table of Contents:

- Nominal Exchange Rate

- Real Exchange Rate

- Comparison

- Factors Affecting Exchange Rates

- Impact on Economy

- Example Calculation

- Summary

Nominal Exchange Rate

The nominal exchange rate is the rate at which one country's currency can be exchanged for another on the foreign exchange market. It is expressed in terms of how much of one currency can be bought with another.

Real Exchange Rate

The real exchange rate takes into account changes in price levels between countries and is adjusted for inflation. It reflects the relative purchasing power of two currencies.

When it comes to exchange rates, there are two main types to consider: nominal exchange rate and real exchange rate. While nominal exchange rate simply reflects the value of one currency in relation to another, the real exchange rate takes into account factors such as inflation and purchasing power.

The real exchange rate provides a more accurate picture of a country's competitiveness in international trade, as it accounts for changes in prices and reflects the actual purchasing power of each currency. By factoring in inflation, the real exchange rate helps determine whether a country's currency is overvalued or undervalued in relation to its trading partners.

Overall, understanding the difference between nominal exchange rate and real exchange rate is crucial for policymakers, economists, and investors to make informed decisions about international trade and investments.

Comparison

While the nominal exchange rate is based on current market values, the real exchange rate provides a more accurate measure of the true value of a currency in terms of purchasing power.

Comparison of Nominal Exchange Rate vs. Real Exchange Rate

When looking at exchange rates, it's important to understand the difference between nominal exchange rate and real exchange rate.

Nominal Exchange Rate: This is the rate at which one currency can be exchanged for another. It is the price of one currency in terms of another and is influenced by factors such as inflation rates, interest rates, and market speculation.

Real Exchange Rate: The real exchange rate takes into account changes in price levels between countries, making adjustments for inflation. It measures the purchasing power of one currency relative to another, providing a more accurate picture of the actual value of the exchange.

While the nominal exchange rate is the rate you see quoted in the financial news and currency exchange rates, the real exchange rate is a more meaningful measure of a currency's value in terms of its purchasing power.

Understanding the difference between nominal and real exchange rates can help individuals and businesses make informed decisions when dealing with international trade, investments, and travel.

It's important to consider both the nominal and real exchange rates when assessing the value of a currency and its impact on the economy.

Factors Affecting Exchange Rates

Exchange rates are influenced by factors such as interest rates, inflation, government policies, and economic indicators. These factors can cause fluctuations in both nominal and real exchange rates.

Impact on Economy

Changes in exchange rates can have a significant impact on a country's economy, affecting exports, imports, inflation, and overall economic growth. Understanding the differences between nominal and real exchange rates is crucial for policymakers and investors.

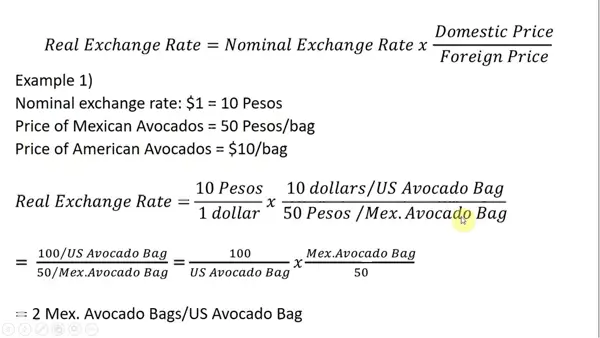

Example Calculation

For example, if the nominal exchange rate between the US dollar and the euro is 1.20, but the inflation rate in the US is 2% higher than in the Eurozone, the real exchange rate would be adjusted to reflect this difference in purchasing power.

Summary

In summary, while the nominal exchange rate provides a simple measure of currency value, the real exchange rate takes into account inflation and purchasing power differences between countries. Understanding these differences is essential for making informed decisions in international finance.

Key Takeaways:

- nominal exchange rate is based on current market values, while real exchange rate adjusts for inflation

- factors affecting exchange rates include interest rates, inflation, and government policies

- exchange rate fluctuations can impact a country's economy and trade balance

FAQ:

What is the main difference between nominal exchange rate and real exchange rate?

The main difference is that nominal exchange rate is based on current market values, while real exchange rate is adjusted for inflation.

How do factors like interest rates and inflation affect exchange rates?

Factors like interest rates and inflation can influence investor confidence in a country's economy, which in turn affects the value of its currency.

No comments:

Post a Comment