A Survey on Contracts for Difference (CFD) and Spread Bets

The survey covered different aspects of CFD and spread betting instruments and was sent to more than 1000 people - a group comprising of money managers, traders, retail investors and HNWIs which offers valuable insights into the preferences of investors.

The objective of the survey was to discern the rationale and risk perception of active investors regarding CFDs/spread betting. The survey was also designed to identify key trends and preferences in sections of the investment community that is using CFDs/spread betting to take exposure to financial markets. For the purpose of interpretation, the survey has been divided into 3 sections:

1. Do you trade Contracts for Difference (CFDs) and/or spread bets?

Almost half of the respondents (46%) trade CFDs compared to 37% who trade using spread betting. The remaining 17% trade in both these instruments.

2. Which other instruments do you also trade? (Choose all relevant fields)

Majority of the respondents also trade in equities (79%) and ETFs (72%) while a smaller chunk trade in investment trusts (31%), bonds (28%) and futures (21%) as well. A small slice of the survey pool (7%) traded in options as well.

3. Which markets do you trade in? (Choose all relevant fields)

A significant proportion of the respondents traded in the FTSE 100 Index (66%) closely followed by individual stocks (62%), highlighting the more popular markets. Less than half of the respondents traded in US markets based indices like S&P500 (35%), FX (28%), commodities (24%), other ex-UK European indices like DAX (24%) and Asian markets (21%).

10% of the respondents traded in markets other than these such as the fixed income space and UK mid and small cap.

4. What are the major attractions and benefits of CFD and spread bet trading? (Choose all relevant fields)

A significant 69% of the respondents each think that both high leverage and the ability to short-sell are major factors attracting traders towards CFDs and spread betting. Tax benefits (54%) also constitutes a significant factor, though stop losses (15%) turned out to be a less important factor. 8% of the respondents reported other influencing factors such as the opportunity to manage one’s own money directly or having an option for short-selling even if not primarily interested in doing so.

5. Which CFD/spread bet provider do you subscribe to? (Choose all relevant fields)

There is a significant preference towards subscribing to IG as the CFD/spread bet provider, with 39% of respondents. 13% of the respondents subscribe to each of CMC Markets and City Index while just 4% subscribe to Capital Spreads. The rest of the market is quite fragmented with 22% of the respondents subscribing to other providers such as City Credit Capital Ltd, Saxo and Monument.

However, 13% of the respondents claim to have more than one CFD/spread betting service provider.

6. For how many years have you traded using leverage?

Over half of the respondents (52%) reported trading using leverage for 1 to 5 years while 22% have traded this way for 5 to 10 years. Respondents who have the largest experience (greater than 10 years) constitute 17% of the respondents and only 9% reported having an experience of less than 1 year in trading using leverage.

7. Which trading strategies do you adopt frequently? (Choose all relevant fields)

According to the survey results, there is no clear majority in the trading strategies used. An equal proportion of the survey pool adopts buy and hold as well as shorting strategies, with 46% of respondents identifying each of these two as a strategy that they adopt. A significant 38% of respondents use leveraging strategies frequently while 29% of respondents employ 1-5 days and greater than 5 days trading strategies. Intraday trading seems to be less popular with only 21% of the respondents using it frequently.

A small slice of the survey pool (4%) employ other strategies like automated strategies-signal following.

8. In the past 12 months what would be your average holding position period for a position?

Respondents are close to evenly split over the average holding period for a position in the past year. Traders who have holding periods of 1-5 days and greater than 5 days constitute 46% of the respondents each while intraday traders along with traders having other holding periods (like greater than 30 days) constitute 4% of the respondents each.

9. In the past 12 months, under what range did your average leverage factor fall for equities?

Just under half the respondents (48%) reported their average leverage factors for equities lying in the 5x range while a significant 35% report average leverage factors in the 2x range. A further 13% of those surveyed had high average leverage factors (10x) and a small slice (4%) had even higher average leverage factors in the range of 10-20x.

10. In the past 12 months under what range did your average leverage factor fall for commodities?

Respondents are split over the majority average leverage factor used for commodities. Traders who have average leverage factors of 5x and 2x constitute 38% of the respondents each. 9% of the respondents are leveraged up to 10x levels while a further 5% are leveraged at even higher levels (10-20x). The remaining 10% fall outside these categories. Some of them didn’t use any leverage for commodities.

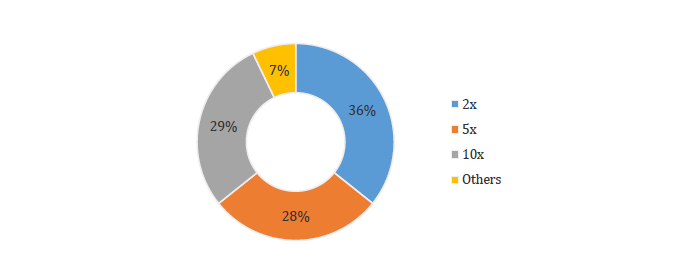

11. In the past 12 months, under what range did your average leverage factor fall for FX?

There is no clear majority when it comes to the average leverage factor for FX. The majority of respondents (36%) employ two-times leverage while a further 29% of the respondents employ leverage up to 10 times. They are closely followed by 28% of respondents who use leverage factors of 5x while a meagre 7% constitute other leveraging strategies, some of which don’t do use any leveraging.

12. What gains or losses have you gained over the last 12 months?

There is almost an even split while analysing returns of respondents over the last 12 months. The largest single group of respondents (27%) report small gains, while the next largest group (23%) report significant gains, breakeven and small losses each. However, a small number of those polled (4%) experienced significant losses.

13. Have you had margin calls over the last 12 months and how many in total?

The majority of respondents (57%) didn’t face any margin calls over the last 12 months. A single margin call was experienced by 26% of respondents while 13% of the respondents faced fewer than 5 margin calls. Respondents who faced more than 10 margin calls were in the clear minority (4%).

14. When trading CFDs & spread bets, what are your major risks? (Choose all relevant fields)

There is no prominent risk factor when trading CFDs and spread bets which comes out of the survey. An equal proportion of the survey pool specified losing more than the original investment and being closed out as major risks, with 29% of respondents identifying each source. A further 24% considered margin calls as the biggest risk. However, the majority of the respondents (62%) considered all the three risks collectively as major factors when trading CFDs and spread bets.

15. Rank your current preferred provider(s) according to the services they provide from 1 to 5. (5 being the best and 1 being the worst).

Analysing the chart from the perspective of services provided, we can see that the majority of the respondents (32%) have placed the service levels of their preferred provider in the top ranked category while a further 21% giving 2nd rank to their provider. Despite a fragmented industry structure, nearly 61% of respondents ranked their preferred provider average or below average in terms of cost. Liquidity has come across as a key concern with 16% of respondents ranking their preferred service provider worst in terms of liquidity while another 37% ranked their service provider as average.

In terms of education, only 5% of respondents have ranked their service provider as the best, while nearly 58% ranked them as average or below-average. This is significant considering the fact that there are high levels of risks associated with CFDs/spread betting and a majority of investors started trading leverage fewer than 5 years ago.

16. In terms of provider risks, which of the following concerns you the most?

In terms of provider risks, the financial risks of the provider clearly ranks at the top (40%). This is followed by various other reasons such as poor spreads, client money vs firm money risks and liquidity (15% each). A further 10% are concerned by price discovery in open markets and other issues include the inability to spread bet while working in financial markets.

17. Are you aware that most CFD and spread betting investors lose money?

86% of those polled are aware that most CFD and spread betting investors lose money, though 14% indicate that they were not aware.

18a. Would such a practice of separate trading books (hedged and unhedged) affect your view on trading via CFDs and spread bets?

Just 40% of the survey pool admit that the practice of separate trading books (hedged and unhedged) would affect their view on trading via CFDs and spread bets, with 60% remaining unmoved.

18b. Are you aware if your provider(s) follows a similar practice of maintaining separate trading books?

A compelling majority (71%) of respondents are not aware of their provider(s) following a similar practice of maintaining separate trading books, though the other 29% are.

19a. Would you prefer to trade in a regulated market or an unregulated market?

There is a unanimous verdict regarding the type of market, as all of the respondents reported their preference for a regulated market.

19b. Would you prefer trading where you get leveraged and/or short exposure where you can't lose more than your original investment?

A compelling 86% of respondents would prefer trading with leveraged and/or short exposure provided that they don’t lose more than their original investment compared to the 14% who do not.

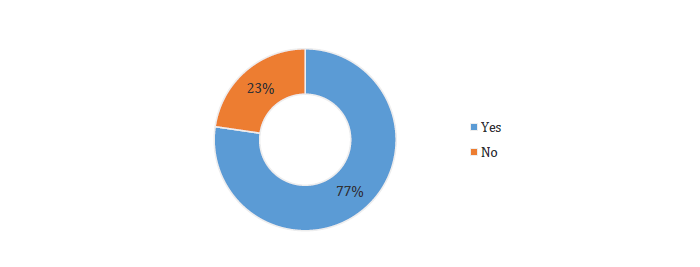

19c. Would you prefer trading where there can be no margin calls?

The majority of respondents (77%) prefer trading where there are no margin calls, compared to the 23% who do not.

19d. Would you prefer trading where you can't be knocked out on a severe market fall?

More than three quarters (77%) of respondents prefer trading when they can’t be knocked out on a severe market fall.

19e. Would you prefer to trade and settle on an exchange rather than against the house?

Unsurprisingly, a compelling 91% of respondents would prefer to trade and settle on an exchange, rather than against the house.

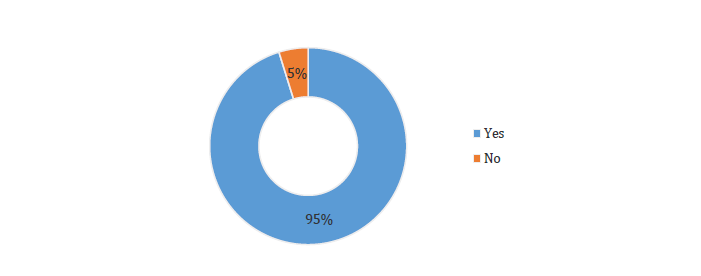

19f. Would you prefer trading a product that has multiple market makers and other investors making sure pricing is transparent and clear?

A clear majority (95%) of respondents prefer trading a product that has multiple market makers and other investors making sure pricing is transparent and clear compared to the 5% who do not.

19g. Would you prefer gaining a leveraged and/or short exposure out of an ordinary London Stock Exchange equity account?

A compelling 95% of respondents would prefer gaining a leveraged and/or short exposure out of an ordinary London Stock Exchange equity account.

19h. Would you prefer trading a product which protects you by mitigating the counterparty risk of the provider?

A clear majority (95%) of respondents prefer trading a product which protects them by mitigating the counterparty risk of the provider.

19i. Would you prefer trading a product that would be able to offset trading losses against capital gains?

Nine-tenths of the respondents prefer trading a product that would be able to offset trading losses against their capital gains.

19j. Would you prefer trading a product that allows you to include this trading in tax wrappers such as SIPPs and ISAs?

Asked whether or not they would prefer trading a product that allows you to include this trading in tax wrappers such as SIPPs and ISAs, a significant majority (91%) answered positively.

19k. Would you prefer trading that allows you to transfer your trading positions easily between providers of your equity account?

A compelling 95% of respondents would prefer trading that allows them to transfer their trading positions easily between providers of their equity accounts.

- The first section providing insights into the habits and motives of investors.

- The second section captures the perception among investors regarding risk/return propositions associated with trading through CFDs/spread betting.

- The final section gauges the preference of investors for a financial instrument that can provide an alternative to CFDs/spread betting while mitigating some key risks associated with investing in an unregulated market.

- A significant majority of respondents actively trade using ETFs. Moreover, exchange traded leverage instruments such as options and futures have not found much favour with CFDs/spread betting investors.

- Shorting, leveraged exposure and tax benefits are key factors that have pulled investors towards CFDs/spread betting platforms in the past.

- A majority of respondents have started using leverage only in the last 5 years.

- Contrary to popular belief, an abnormally large proportion of investors have maintained their position for more than 5 days over the last 12 months.

- Across asset classes, investors have preferred to trade at leverage level ranges of 2x-5x in the past year.

- The last 12 months, in general, has been good for respondents and most of them passed the year in green and without any margin calls.

- However, investors are equally concerned about each of the key trading risk factors associated with CFDs/spread betting instruments such as losing more money than the original investment, being closed out of the market and margin calls.

- In the wake of recent bankruptcies, the financial risks of a provider has been singled out as the most significant concern among investors when it comes to regulatory aspect of trading.

- Most investors are also not aware about the practice of keeping separate books among providers, which raises questions pertaining to investor awareness.

- Nearly every investor would prefer an alternate financial instrument to CFDs/spread betting which can provide the desired leveraged exposure while allowing trading in a regulated market.

- Investors yearn to get leveraged/short exposure without exposing themselves to margins calls, unlimited risk (losing even more than the original investment), counterparty risk and knock-outs.

- An overwhelming majority of respondents prefer the advantages of a regulated market place such as liquidity, transparent price discovery and ease in switching between providers.

- Rather than maintain two accounts, investors have shown interest in using an instrument that can provide leveraged/short exposure through their traditional equity accounts which is covered in tax wrappers such as SIPPs and ISAs.

1. Do you trade Contracts for Difference (CFDs) and/or spread bets?

Almost half of the respondents (46%) trade CFDs compared to 37% who trade using spread betting. The remaining 17% trade in both these instruments.

2. Which other instruments do you also trade? (Choose all relevant fields)

Majority of the respondents also trade in equities (79%) and ETFs (72%) while a smaller chunk trade in investment trusts (31%), bonds (28%) and futures (21%) as well. A small slice of the survey pool (7%) traded in options as well.

3. Which markets do you trade in? (Choose all relevant fields)

A significant proportion of the respondents traded in the FTSE 100 Index (66%) closely followed by individual stocks (62%), highlighting the more popular markets. Less than half of the respondents traded in US markets based indices like S&P500 (35%), FX (28%), commodities (24%), other ex-UK European indices like DAX (24%) and Asian markets (21%).

10% of the respondents traded in markets other than these such as the fixed income space and UK mid and small cap.

4. What are the major attractions and benefits of CFD and spread bet trading? (Choose all relevant fields)

A significant 69% of the respondents each think that both high leverage and the ability to short-sell are major factors attracting traders towards CFDs and spread betting. Tax benefits (54%) also constitutes a significant factor, though stop losses (15%) turned out to be a less important factor. 8% of the respondents reported other influencing factors such as the opportunity to manage one’s own money directly or having an option for short-selling even if not primarily interested in doing so.

5. Which CFD/spread bet provider do you subscribe to? (Choose all relevant fields)

There is a significant preference towards subscribing to IG as the CFD/spread bet provider, with 39% of respondents. 13% of the respondents subscribe to each of CMC Markets and City Index while just 4% subscribe to Capital Spreads. The rest of the market is quite fragmented with 22% of the respondents subscribing to other providers such as City Credit Capital Ltd, Saxo and Monument.

However, 13% of the respondents claim to have more than one CFD/spread betting service provider.

6. For how many years have you traded using leverage?

Over half of the respondents (52%) reported trading using leverage for 1 to 5 years while 22% have traded this way for 5 to 10 years. Respondents who have the largest experience (greater than 10 years) constitute 17% of the respondents and only 9% reported having an experience of less than 1 year in trading using leverage.

7. Which trading strategies do you adopt frequently? (Choose all relevant fields)

According to the survey results, there is no clear majority in the trading strategies used. An equal proportion of the survey pool adopts buy and hold as well as shorting strategies, with 46% of respondents identifying each of these two as a strategy that they adopt. A significant 38% of respondents use leveraging strategies frequently while 29% of respondents employ 1-5 days and greater than 5 days trading strategies. Intraday trading seems to be less popular with only 21% of the respondents using it frequently.

A small slice of the survey pool (4%) employ other strategies like automated strategies-signal following.

8. In the past 12 months what would be your average holding position period for a position?

Respondents are close to evenly split over the average holding period for a position in the past year. Traders who have holding periods of 1-5 days and greater than 5 days constitute 46% of the respondents each while intraday traders along with traders having other holding periods (like greater than 30 days) constitute 4% of the respondents each.

9. In the past 12 months, under what range did your average leverage factor fall for equities?

Just under half the respondents (48%) reported their average leverage factors for equities lying in the 5x range while a significant 35% report average leverage factors in the 2x range. A further 13% of those surveyed had high average leverage factors (10x) and a small slice (4%) had even higher average leverage factors in the range of 10-20x.

10. In the past 12 months under what range did your average leverage factor fall for commodities?

Respondents are split over the majority average leverage factor used for commodities. Traders who have average leverage factors of 5x and 2x constitute 38% of the respondents each. 9% of the respondents are leveraged up to 10x levels while a further 5% are leveraged at even higher levels (10-20x). The remaining 10% fall outside these categories. Some of them didn’t use any leverage for commodities.

11. In the past 12 months, under what range did your average leverage factor fall for FX?

There is no clear majority when it comes to the average leverage factor for FX. The majority of respondents (36%) employ two-times leverage while a further 29% of the respondents employ leverage up to 10 times. They are closely followed by 28% of respondents who use leverage factors of 5x while a meagre 7% constitute other leveraging strategies, some of which don’t do use any leveraging.

12. What gains or losses have you gained over the last 12 months?

There is almost an even split while analysing returns of respondents over the last 12 months. The largest single group of respondents (27%) report small gains, while the next largest group (23%) report significant gains, breakeven and small losses each. However, a small number of those polled (4%) experienced significant losses.

13. Have you had margin calls over the last 12 months and how many in total?

The majority of respondents (57%) didn’t face any margin calls over the last 12 months. A single margin call was experienced by 26% of respondents while 13% of the respondents faced fewer than 5 margin calls. Respondents who faced more than 10 margin calls were in the clear minority (4%).

14. When trading CFDs & spread bets, what are your major risks? (Choose all relevant fields)

There is no prominent risk factor when trading CFDs and spread bets which comes out of the survey. An equal proportion of the survey pool specified losing more than the original investment and being closed out as major risks, with 29% of respondents identifying each source. A further 24% considered margin calls as the biggest risk. However, the majority of the respondents (62%) considered all the three risks collectively as major factors when trading CFDs and spread bets.

15. Rank your current preferred provider(s) according to the services they provide from 1 to 5. (5 being the best and 1 being the worst).

Analysing the chart from the perspective of services provided, we can see that the majority of the respondents (32%) have placed the service levels of their preferred provider in the top ranked category while a further 21% giving 2nd rank to their provider. Despite a fragmented industry structure, nearly 61% of respondents ranked their preferred provider average or below average in terms of cost. Liquidity has come across as a key concern with 16% of respondents ranking their preferred service provider worst in terms of liquidity while another 37% ranked their service provider as average.

In terms of education, only 5% of respondents have ranked their service provider as the best, while nearly 58% ranked them as average or below-average. This is significant considering the fact that there are high levels of risks associated with CFDs/spread betting and a majority of investors started trading leverage fewer than 5 years ago.

16. In terms of provider risks, which of the following concerns you the most?

In terms of provider risks, the financial risks of the provider clearly ranks at the top (40%). This is followed by various other reasons such as poor spreads, client money vs firm money risks and liquidity (15% each). A further 10% are concerned by price discovery in open markets and other issues include the inability to spread bet while working in financial markets.

17. Are you aware that most CFD and spread betting investors lose money?

86% of those polled are aware that most CFD and spread betting investors lose money, though 14% indicate that they were not aware.

18a. Would such a practice of separate trading books (hedged and unhedged) affect your view on trading via CFDs and spread bets?

Just 40% of the survey pool admit that the practice of separate trading books (hedged and unhedged) would affect their view on trading via CFDs and spread bets, with 60% remaining unmoved.

18b. Are you aware if your provider(s) follows a similar practice of maintaining separate trading books?

A compelling majority (71%) of respondents are not aware of their provider(s) following a similar practice of maintaining separate trading books, though the other 29% are.

19a. Would you prefer to trade in a regulated market or an unregulated market?

There is a unanimous verdict regarding the type of market, as all of the respondents reported their preference for a regulated market.

19b. Would you prefer trading where you get leveraged and/or short exposure where you can't lose more than your original investment?

A compelling 86% of respondents would prefer trading with leveraged and/or short exposure provided that they don’t lose more than their original investment compared to the 14% who do not.

19c. Would you prefer trading where there can be no margin calls?

The majority of respondents (77%) prefer trading where there are no margin calls, compared to the 23% who do not.

19d. Would you prefer trading where you can't be knocked out on a severe market fall?

More than three quarters (77%) of respondents prefer trading when they can’t be knocked out on a severe market fall.

19e. Would you prefer to trade and settle on an exchange rather than against the house?

Unsurprisingly, a compelling 91% of respondents would prefer to trade and settle on an exchange, rather than against the house.

19f. Would you prefer trading a product that has multiple market makers and other investors making sure pricing is transparent and clear?

A clear majority (95%) of respondents prefer trading a product that has multiple market makers and other investors making sure pricing is transparent and clear compared to the 5% who do not.

19g. Would you prefer gaining a leveraged and/or short exposure out of an ordinary London Stock Exchange equity account?

A compelling 95% of respondents would prefer gaining a leveraged and/or short exposure out of an ordinary London Stock Exchange equity account.

19h. Would you prefer trading a product which protects you by mitigating the counterparty risk of the provider?

A clear majority (95%) of respondents prefer trading a product which protects them by mitigating the counterparty risk of the provider.

19i. Would you prefer trading a product that would be able to offset trading losses against capital gains?

Nine-tenths of the respondents prefer trading a product that would be able to offset trading losses against their capital gains.

19j. Would you prefer trading a product that allows you to include this trading in tax wrappers such as SIPPs and ISAs?

Asked whether or not they would prefer trading a product that allows you to include this trading in tax wrappers such as SIPPs and ISAs, a significant majority (91%) answered positively.

19k. Would you prefer trading that allows you to transfer your trading positions easily between providers of your equity account?

A compelling 95% of respondents would prefer trading that allows them to transfer their trading positions easily between providers of their equity accounts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of The NASDAQ OMX Group, Inc.

No comments:

Post a Comment